Issue: Vol 168, Issue 4334

9 Dec 2011

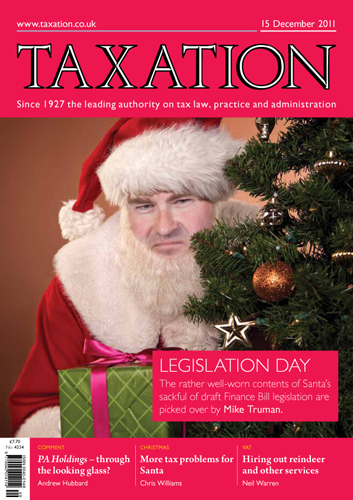

NEIL WARREN considers practical solutions to help Santa Claus with his new business activity

MIKE TRUMAN peeks at some rather familiar items in St Nick’s sack of draft Finance Bill proposals

ANDREW HUBBARD, aficionado of conundrums, casts a wry eye over the Court of Appeal’s decision in the PA Holdings case

CHRIS WILLIAMS believes he has an unreasonable excuse for seasonal jollity

A director of a one-man IT company has been trading for many years, but the current single contract is to end soon. The company has large cash reserves and the director is considering the purchase of...

A non-domiciled client spends one or two years as resident in the UK every seven or so years and is subject to the remittance basis. He made a capital gain overseas and remitted part of this while...

A limited company bought land and built houses on it, which were sold on the open market at a loss. Two years later, after a period of no trading, the company plans to renovate properties from another...

A builder had a large contract to provide building services constructing a new bungalow on land owned by a farmer. He zero-rated his building services because he was building a new dwelling from bare...

Reining in costs; Christmas gifts; Subcontract Santa; Temp toymakers

Agent authorisation only where there is existing claim

Online agent authorisation deadline is 16 Jan

Happy Christmas; Swiss questions; Bank levy; VAT concession

New penalties for late self assessment returns

Taxman explains view of judgment in CRC v Rank Group plc

Corporation tax measures summarised

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES