Issue: Vol 169, Issue 4353

11 May 2012

MIKE TRUMAN believes a recent case has created confusion about definitions

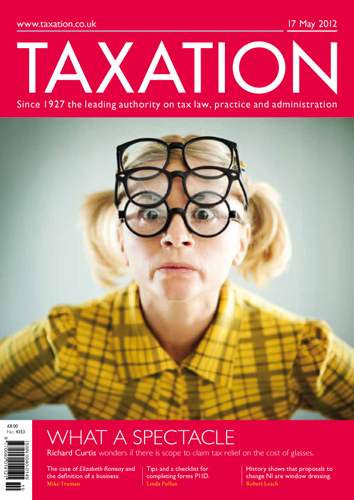

Can you claim a tax deduction for the cost of a pair of glasses? RICHARD CURTIS takes a look

ROBERT LEACH traces the evolution of National Insurance since its introduction 100 years ago

Practical tips on completing employer-clients' P11Ds, by LINDA PULLAN

A non-charitable trust was established in March 1998, with the settlor’s grandchildren as beneficiaries. The settlor died in April 2010 and a bond held by the trust matured at the end of 2010/11

A company operates a golf course and also owns some buy-to-let properties. It has recently taken on a new employee and will rent one of the properties to him at a market rent

A daughter and her two minor children are the beneficiaries of a discretionary trust. The trustees, the daughter and her husband have purchased a property in which the family will live

A married couple own their main private residence and intend to grant a right of way over their driveway to provide access to a new adjoining property

Returning Japanese; Payback time; Seeking relief; Farmer and son

RPI; Barbados DTA; Isle of Man; Security for cars; Film unit; Email contact

First Employment-Related Shares & Securities Bulletin published

E92 must be accompanied by E89

Further 310 employer schemes in pilot

Approach is 'points mean prizes', says Grant Thornton tax boss

Single-purpose variety will be taxed when issued, after Lebara VAT case

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES