Issue: Vol 170, Issue 4360

29 Jun 2012

SHARON McKIE scrutinises the proposed statutory residence test

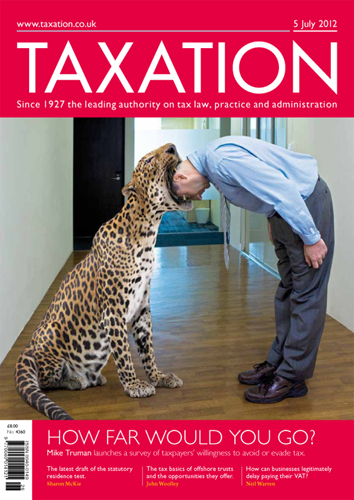

MIKE TRUMAN launches our survey of attitudes toward avoidance and evasion

The tax benefits of using trusts outside of the UK are limited, finds JOHN WOOLLEY

NEIL WARREN considers how a business can improve its VAT cash flow position and gain time to pay the tax due

A husband and wife separated seven years ago. A second property was built in the grounds of what was the matrimonial home and the husband now occupies this, while the wife remains in their original...

Land can effectively be transferred by a deed stating that the legal owner holds this as trustee for another, but can this be done for other property, such as shares?

A client operates his consultancy through a limited company. The business is run from his home, which is in fact his parent’s main residence where he also lives. Could the company pay a rent for its...

A client’s application for the renewal of exception from liability to payment of Class 2 National Insurance contributions has been refused by HMRC as she now receives income from let properties

Bungalow bill; Live and let live; Portfolio partition; Start again?

Consultation to oversome academics' problem

ISA Bulletin 44; IHT form; Contracting out; Stamp taxes; Thoughts on VAT; Tax transparency

Delinquent taxpayers can get up to date without punishment

Call for UK to charge 20% on energy-saving materials

Changes to combat laundering must be put in place immediately

Most UK taxpayers will be exempt from NI payments elsewhere

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES