Issue: Vol 170, Issue 4382

28 Nov 2012

HMRC’s anti-avoidance strategy could be more effective, says the National Audit Office. ALLISON PLAGER reports

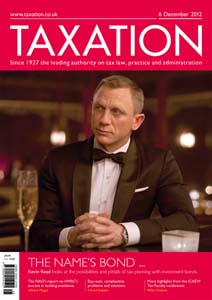

...investment bond: how not to let the sky fall on tax planning

A management team is anticipating large rewards in a company buyout. CHRIS CHAPPLE looks at potential problems and their solutions

MIKE TRUMAN provides further highlights from Chartered Accountants Hall, London

A new company has been set up to develop a product for the renewable energy sector. Development of the product will take five years and only then will construction take place

Having incorporated an accountancy practice some years ago and given minority shareholdings to two assistants, the owner is now looking to retire

A property consisting of a ground floor shop, a flat above, and land to the rear is to be sold. The new owner intends to convert the shop into a flat and then build a new residential property on the...

Among other business and employment activities, a client is also a part-time self-employed lorry driver working for various businesses in different locations

On the bypass; In the frame; Roving architect; Addled add-backs

Move follows Court of Appeal judgment in First Nationwide

Bank levy; Gift aid; Patent box; New helpsheets; Volunteer advisers

HMRC guidance

CIOT: errors in full-payment entries should apply only at end

Poor performers selected to discuss client compliance

Colin Summers; Christopher Summers (TC2267)

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES