Issue: Vol 172, Issue 4423

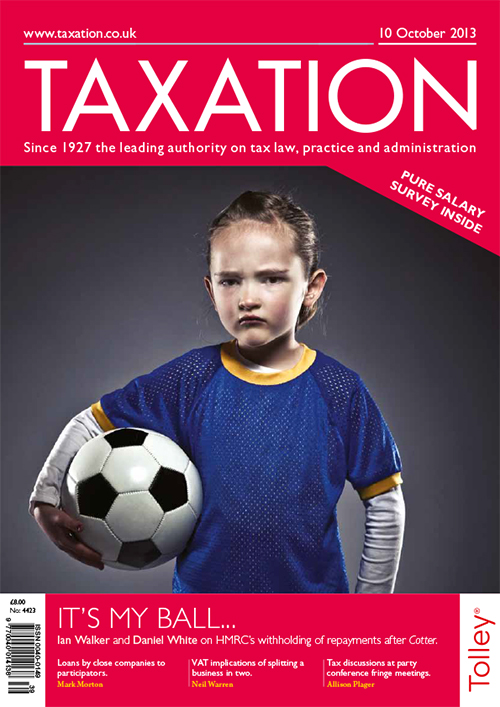

10 Oct 2013When can HMRC withhold a tax repayment, and – as the Supreme Court hears the arguments in the Cotter case – are the department’s views correct?

Situations in which business splitting can avoid an output tax problem or liability

Warning: there can be adverse consequences to breaking new regulations on loans to participators

The future was the focus of two tax events during the Labour party conference

A company had a plan for a new business venture, but required an injection of capital to progress. The shareholder’s wife loaned money to the company and is being paid interest. Is this allowable and...

A company is planning to cease trading in three years’ time. It has a substantial share premium account represented by cash, but there is concern that a distribution of this will be treated as income...

A UK-based supplier is selling car parts, purchased from a manufacturer in Hungary, to a customer in South Africa. The Hungarian firm is insisting that it should charge 27% VAT

Two shareholders own two companies, but unequal shareholdings. They wish to go their separate ways and are willing to carry out a share swap to each achieve independent ownership of one of the...

...Flat rate franchise; Acquisition value

Workers and employers in the tax sector have been offered a boost by the results of the latest UK salary survey from recruitment firm Pure, which has tentatively predicted a rise in staffing levels....

A new digital service for taxpayers in the PAYE system is set to be launched in April 2014 – and HMRC are looking for people willing to help with testing.

The department wants the help of workers with...

Married tax break

Married couples and civil partners will be able to transfer up to £1,000 of their personal allowance to their partner from 2015/16. HMRC say their “current working assumption” is...

Brief issued following ITV decision by appeal court

The scope and operation of the listed places of worship grant scheme have been revamped, enabling a wider range of locations to be eligible.

The revisions make suitable works to pipe organs, turret...

HMRC have introduced cheaper telephone numbers have been introduced for areas including corporation tax, trusts and estates, tax credits, and retirement annuity contracts. The new helplines will...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES