Issue: Vol 173, Issue 4445

27 Mar 2014Informing on an ex-spouse is not a good idea

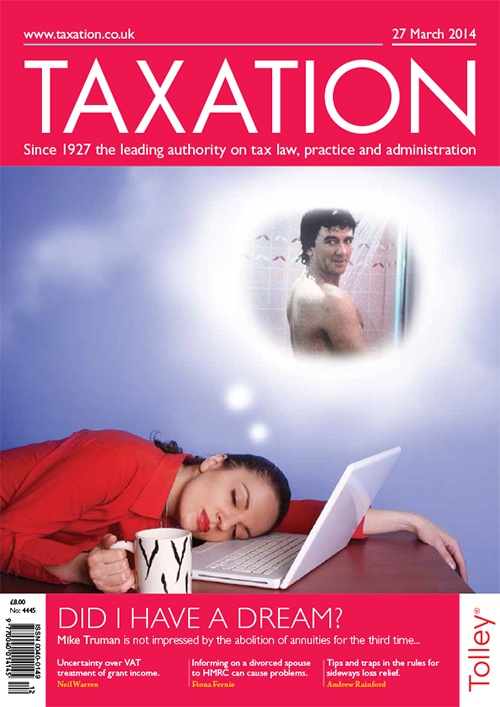

The chancellor’s claim to have axed the need for a pension annuity is unimpressive – and familiar

A recent VAT decision could create uncertainty for charities’ grant income

When to set off trading losses sideways or backwards, and when to carry forward

Non-res & dividends; Personal loan; Matter of form; Bank loan write off

A woman wishes to buy a property in Florida. She and her husband are 50:50 shareholders of a limited company through which she carries on her trading business. The company is cash rich, so the client...

A previously VAT-registered client bought a derelict commercial property and converted it into four flats and a shop, all of which will be let out

The shares of a trading company are owned by three individuals. One of them wishes to leave. The suggestion is that a new company is formed that will purchase the trade of the existing one and then...

A brother and sister own a property they inherited 20 years ago. It has been used by family members and more recently has been let out. To benefit her brother, the sister has suggested she could...

Help for employers

HMRC have produced two helpsheets on getting ready for April 2014 and the tax year ahead. The first covers what employers need to do to get ready for their final 2013/14...

A new scheme of tax-free childcare is scheduled to launch in autumn 2015 and rolled out within a year to all eligible families with children under 12, the government has announced. An earlier version...

Views sought on tax reform of defined contribution savings

RTI guidance updated

The new tax and National Insurance (NI) rules on offshore employment intermediaries will take effect from 6 April.

With regard to offshore intermediaries:

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES