Issue: Vol 173, Issue 4448

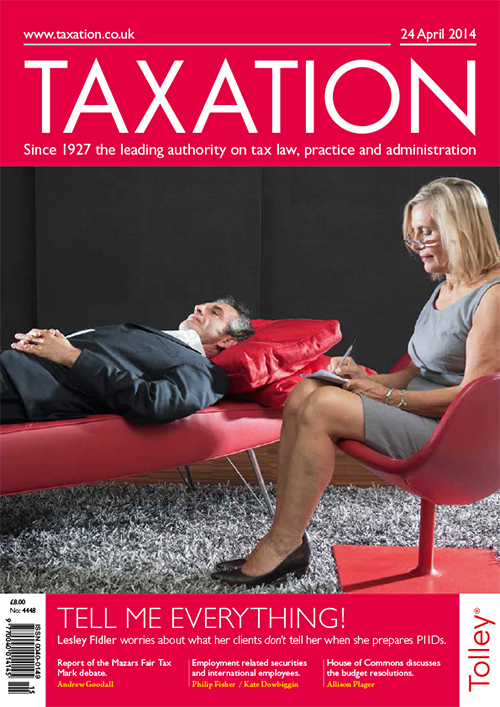

24 Apr 2014It’s what your clients don’t reveal that causes problems with P11Ds

A rule change could have devastating consequences for globetrotting employees

A view of the House of Commons’ Budget debate

QCB transactions; Children and concerns; Remittance dilemma; LLP with company

A new partner in a successful firm is required to introduce capital funds into the business. His wife has surplus cash in a savings account that she could lend to her husband

There is uncertainty as to whether a form R185 (Trust Income) or a form R185 (Settlor) should be issued when a settlor is the beneficiary of an interest in possession trust

Is the tax liability on close company dividends when paid to non-residents still limited to the tax credit?

ATT wants 19 May cut-off for payroll submissions

Kestrel Guards Ltd (TC3324)

Download the exclusive Xero

free report here.