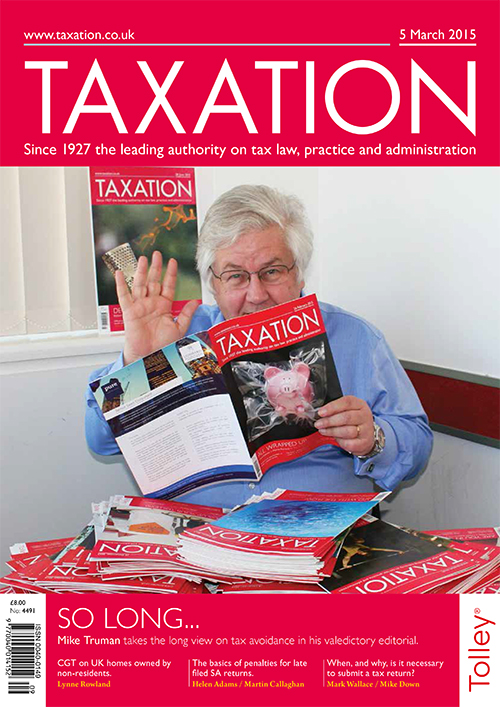

Issue: Vol 175, Issue 4491

5 Mar 2015Capital gains issues for non-residents disposing of UK property

The price of late-filed returns and failure to pay tax on time

How attitudes to avoidance have changed – and an adieu from the author

The inconsistent criteria for completing a self assessment return

VAT on improvements; Interesting idea; Slightly Chile; Professional pension

What are the chances of a successful appeal against a late filing penalty?

Would the gift of a house to an employed friend be a taxable benefit in kind?

Potential tax liability on freelance income of a UK citizen resident in Japan

Determining the correct VAT flat rate for vehicle painting and repairs

France gives okay to information-share with agencies outside HMRC

B Kelly (TC4108)

Tower Radio Ltd; Total Property Support Services Ltd v CRC, Upper Tribunal

Download the exclusive Xero

free report here.