Key points

- Decimal currency introduced to the UK 50 years ago.

- Attempts at decimalisation started in the 18th century.

- The end of the guinea and the farthing.

- Abolition of some stamp taxes.

- Replacement of reliefs and surtax with unified taxation.

It was 50 years ago this month, on 15 February 1971, that the UK adopted decimal currency. The pound was, and remains, the oldest national currency in use, yet the UK was one of the last countries to decimalise. The decision was finally made in 1966, the Decimal Currency Act was passed in 1969, and the first decimal coins were issued in a blue plastic folder.

One idea was to create a new pound worth ten shillings. As there were 120 old pence in ten shillings, this would have meant that a new penny was worth just over one old penny. Because these were the days of fixed exchange rates, the idea was rejected as it would look like devaluation. Another idea was to call the new small currency decimal pence. A set of coins was designed with this name. In the end, the description was ‘new pence’. The word new was dropped in 1982.

Before decimalisation, the pound was the same unit but was divided into 20 shillings which were each divided into 12 pence, so there were 240 pence in £1. The penny was divided into two halfpennies or (until 1960) four farthings. There were thus 480 halfpennies or 960 farthings to the pound.

This system had evolved over the centuries from Roman times as was evident in the unfortunate abbreviation of LSD for the old currency, representing the Latin names librae, solidi and denarii. The pound currency was fixed as the value of a pound of silver in the Middle Ages. There is still a unit of weight used in jewellery called the pennyweight of 1/240th of a pound.

A practical change

The impracticality of pre-decimal currency was obvious. How much should be charged for items sold at £1 16s 11½d each, but with a 10% discount for three? The answer is given later in this article. There were special calculators to help, and books of ready reckoners.

Attempts to decimalise the currency can be dated back to the 17th century. In 1841, a Decimal Association was formed to campaign for decimal currency. The matter was investigated before being rejected in 1859 as having ‘few merits’. One early provision was the introduction in 1849 of the florin or two-shilling coin, worth one tenth of a pound. This was followed by the issue of a double florin worth four shillings minted only between 1887 and 1890. When pre-decimal coins were demonetised, the double florin was overlooked so, in theory at least, the coin remains legal tender for 20p.

Because the pound itself did not change, there was no change to bank notes, except that the ten shilling (half a pound) note was replaced by a 50p coin that is still with us, though now a little smaller. Before decimalisation, the coins were a curious range for a half, one, three, six, 12, 24 and 30 pence, with nothing until the ten shilling note. The 30 pence coin was the half-crown of 2s 6d, worth one-eighth of a pound. Yet there was no crown of five shillings in circulation. The last attempt at a circulation crown was made in 1951. Crowns continued to be minted as commemorative coins until 1981, to celebrate Prince Charles’ wedding to Lady Diana.

Coinage confusion

The coins themselves were a curious mixture of sizes and shapes. The penny was a large coin out of proportion to its value. Pennies from 1860 were still being used after more than a century, by which time many were thin black discs.

To add to the confusion, there was still a unit of a guinea, which was worth 21 shillings (now £1.05) even though a coin to that value had not been minted since 1813. Professional fees and clothing were often priced in guineas, but this practice died out not long after decimalisation.

The old currency changed our understanding of currency. Until 1914, the value of coins was based on the metal from which it was made. A bank would weigh gold sovereigns and accept these for less than £1 if underweight because of wear. Bank notes were originally receipts for gold deposits. The First World War saw a need to conserve gold, so the process started of issuing coins and notes whose authority depended on government fiat. Because these notes and coins cost less to produce, the government made a profit on their supply. This profit is called seignorage and is sometimes seen as a tax.

Some blamed decimalisation for increases in prices, though this is not supported by hard evidence. Most roundings to the new currency were in the customer’s favour. The 5p and 10p coins were made the same size as the shilling and florin they replaced, so both coins could circulate for the same value. Amounts as small as six pence (2½p) could be converted exactly.

Introduction of the new currency

The changeover was handled well. Shops and banks were given advance supplies of new coins so they could cash cheques and give change from day one. From ‘decimal day’ prices were given in the new currency with pre-decimal figures in brackets. Charts and educational programmes had been prepared, including toy money to teach children.

It was originally intended that there be an 18-month transitional period when both the old and new currencies would circulate. This would also allow time for changes to cash registers, slot machines and accounting machines. Banks were allowed to close for three days to allow for the changeover. In the event, the new currency was adopted so quickly that the old currency was demonetised on 1 September 1971, by which time few of the old coins were still in use.

Effect on taxation

The most immediate tax effect of decimalisation was for stamp duty. In 1971, this was charged on a wide range of documents. Many were taxed at fixed rates, now largely abolished. Ordinary cheques and receipts were subject to duty at 2d. After some deliberation, these were abolished in 1971.

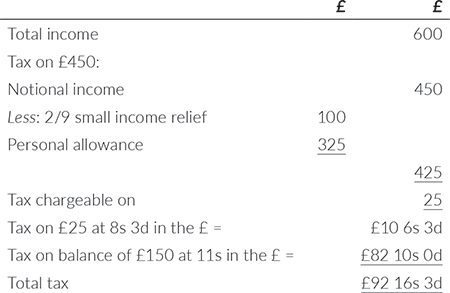

For income tax, the main change was that rates of tax were now expressed as percentages rather than amounts. The basic rate of 8s 3d in the pound was restated as 41.25%. This rate is high because two-ninths of earned income was tax free. This reduces the effective rate to just over 32%.

Also, there were many other reliefs and allowances, plus surtax and other complications.

An income tax guide for 1970-71 gives this worked example for a single woman aged 56 whose only income is £600 a year from an annuity.

The equivalent income today would be about £8,600. So she would now pay no tax at all, and certainly not the equivalent of more than £1,300.

In those days, tax guides were often ready reckoners. This was the original function of PAYE tax tables. Because this was before the ready availability of electronic calculators and computers, the only method of calculation was by ready reckoner or by a mechanical calculator for pre-decimal currency – or by tedious arithmetic where mistakes were common.

Move to simplification

Decimalisation was the first step in a series of long overdue tax simplifications and changes.

The complex income tax formula was replaced in 1973 with ‘unified taxation’. There was a personal allowance and the balance was taxed at 30% until the higher rates applied. Surtax, two-ninth exemptions and notional incomes were all swept away.

In 1973, purchase tax and selective employment tax were replaced by value added tax.

This was followed in 1975 by a change to National Insurance. Previously, this was a fixed weekly amount, represented by a stamp on a card. In 1971, a man paid 20s 1d and his employer also paid 20s 1d. For a woman, the rates were 16s 6d and 17s respectively.

There was also a graduated rate for a graduated pension between 1961 and 1975. This bought units at the rate of sixpence for every £7.50 earned by a man, and £9 earned by a woman. This bought additional pension which is still paid. The disparity between the sexes has now been removed.

Returning to our calculation test above, the price for three items sold at £1 16s 11½d less a 10% discount is £4 19s 9½d. It is £5 10s 10½d before the discount of 11s 1d. Treat yourself to a few shillings’ worth of sweets if you got that right.

Past and present

The 1970s proved to be a sad decade of industrial unrest and high inflation. Rolls-Royce went bust on 4 February, leading to questions as to how this could happen to a company that had a clean audit report. Sound familiar? The accountancy profession responded by issuing statements of standard accounting practice (SSAPs). Because accounts used for tax computations must comply with accounting standards, this was in effect a new form of tax law.

But this negativity was not felt in 1971. This was also the year of colour television, Concorde, hot pants and Bridge Over Troubled Water. On 21 June 1971, the government started successful negotiations to join what became the European Union. What could go possibly wrong?