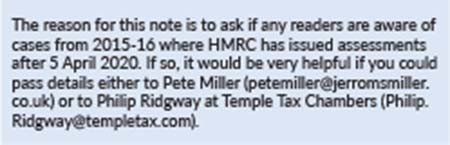

There are a large number of cases where HMRC has issued counteraction assessments under the transactions in securities rules for the year 2015-16. In the cases I am aware of, all the assessments were issued during the tax year 2021-22, mostly in the first three months of calendar year 2022. I am also aware of several other advisers working similar cases with similar timing issues.

This is important because, under the rules that applied until 5 April 2016, we believe that the assessments had to be issued within four years of the end of the tax year in which the tax advantage arose, in other words by 5 April 2020, so that assessments raised by 5 April 2022 were two years too late. Given the number of cases that rely, in whole or in part, on whether HMRC has raised assessments in time, a sensible approach, saving work for all parties, would be to arrange for a lead case on this issue to be considered by the tribunals and the courts.

If the final outcome is that HMRC’s assessments were issued too late, all the cases fall away. On the other hand, if HMRC wins on the timing issue, a number of cases will probably concede, on the basis that the income tax advantage was the main or one of the main reasons for entering into the transactions in securities. Either way, this approach entails considerably less work for all parties, which is why we are advocating it as a sensible way forward.