Trust income

Tax on trust income for non-resident.

My client emigrated to the US a few years ago and is resident there. He has investment income from the UK, mainly dividends of £10,000, and income from a UK resident trust. The income from the trust derives from an interest in possession that consists of property income, UK dividends and UK interest.

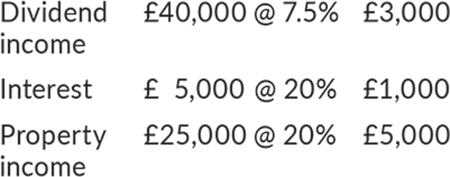

The trustees have paid tax on their income as follows:

As a non-resident, the client’s UK tax liability is limited under ITA 2007, s 811 to the amounts deducted from disregarded income plus the amount of tax for which he would be liable if disregarded income were left out, but no entitlement to personal reliefs.

HMRC has looked through the trust income and has taken both the dividends received personally and the dividends and interest received by the trustees as disregarded income. However, HMRC has treated the tax paid by the trustees on this income as ‘deducted at source’ and has included this tax in the client’s overall tax computation for the year. Is this correct?

The income of a life tenant is often mandated direct to the beneficiary and this could be done with the dividend and interest income. Then the trustees would not be liable to pay the tax, but the income would be assessable directly on the beneficiary. Would that lead to the conclusion that the non-UK resident beneficiary would have no liability on the disregarded income as there had been no deduction of tax at source?

I look forward to hearing from readers.

Query 19,755 – Bypass.

Insurance payment

Tax on insurance payment for delayed roof repairs.

We act for a company that was hit by a tornado that damaged the roof. The insurance assessor awarded a full repair. However, because the company makes all the yellow plastic bins for disposing of Covid needles, it is not practicable for the factory to close for repairs.

The insurance company is worried about being responsible for the roof that remains unrepaired and subsequently fails so it offered the directors a non-refundable cheque for £2m for the roof, regardless of whether it ended up costing less than this.

We need to know how the tax would be calculated on this payment. According to my research, it seems that this would be stage payments that match with the repairs, so there is a part capital gains tax disposal of the freehold but then a reinvestment.

I hope readers can shed some light on this situation.

Query 19,756 – Confused.

Business asset disposal relief

Maximising availability of business asset disposal relief.

My client owns a business which he runs through a limited company. Shareholder reserves are in the negative due to historical losses. The business uses land and buildings owned by the director.

He has received an offer of more than £2m for this land. We are looking at business asset disposal relief (BADR) in relation to the business and the land. The company meets the qualifying criteria, so we do not see any issues on the shares being eligible for relief. Rather than wind up the company, it has been suggested that the shares are transferred to our client’s adult son.

We have not valued the company but would expect that it is negligible. However, if there is some value in the shares, we were wondering whether the disposal of the land as an associated disposal of the company shares would continue to attract BADR if the gain on the transfer of the company shares was held over under business gift relief, rather than reported on our client’s return and BADR claimed on the profit.

Obviously, we want to maximise the relief available against the profit on land, which we expect to exceed £1m. I cannot find any requirement that BADR has to be claimed on the disposal of the shares, just that the shares have to be eligible for the relief.

I would be grateful if readers could provide some assistance.

Query 19,757 – Adviser.

Reverse charge

Three party deal – Brexit complications?

I act for a UK based company that buys and sells bathroom fittings on a wholesale basis throughout the UK and EU.

In anticipation of Brexit, a Dutch subsidiary company was formed – it rents a warehouse in Holland and imports stock directly from China, and is therefore able to meet orders from EU customers.

However, one customer in Sweden will only deal with the UK company, even though the stock will be directly transferred from Amsterdam to Stockholm. The Dutch subsidiary company will therefore invoice my client for the goods with 25% discount (no Dutch VAT charged), giving my client a profit share to cover overheads. My client will invoice the Swedish customer for the goods once they have been delivered.

The Swedish customer says that he can do the reverse charge on his Swedish VAT return to sort things out, as he did before the end of the EU transitional deal. This sounds simple but my experience tells me that with VAT, the simple outcome is not necessarily the right outcome.

Readers’ thoughts would be appreciated.

Query 19,758 – Double Dutch.