Reporting requirements

UK rent, interest and dividends of non-UK resident company.

My client is a non-UK resident company. It has various foreign investments which generate income and gains, but its only UK income is rental income, and some UK interest and dividends. It is properly managed and controlled from overseas and I am happy that it is not resident in the UK.

The UK interest and dividends are not taxable in the UK by virtue of ITA 2007, s 815 and s 825 (disregarded income). The UK rental income has always been reported on a SA700 and charged to income tax. However, from 6 April 2020, the rental income is subject to corporation tax and must be reported on a CT600.

My question is whether the move to corporation tax has any effect on the UK interest and dividends? Are they still subject to income tax and therefore remain disregarded income, or do they become subject to corporation tax?

Can readers provide assistance?

Query 19,631 – Concerned.

Annual maxima

Calculating earnings from three different directorships.

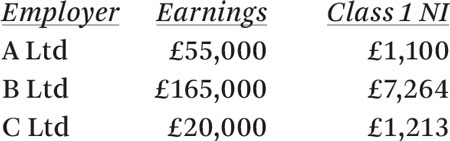

A client’s earnings from three different directorships in 2019-20 were as follows:

Following the seven-step computation in Regulation 21 SI 2001/1004 to calculate the ‘annual maxima’ we computed a repayment due of £1,076. HMRC insists however that the amount due is £831.

As a matter of principle, given that the difference is relatively small, we would appreciate readers’ input as to the correct class 1 National Insurance liability due by this client.

In the copy of its workings provided on our request, it appears that HMRC treated all of the earnings from employment A as ‘earning over upper earnings limit’; £3,584 of the earnings of employment B as ‘earnings at lower earnings limit (LEL)’ and £6,136 of the earnings of employment C as ‘earnings at LEL’.

We are unable to reconcile the figures and readers’ comments would be helpful.

Query 19,632– Maximi.

Shipbuilding

Employee dividend payments through NewCo.

Shippy Ltd, a company in the ship-building industry, is owned and managed by my client, a sole director and shareholder who is expecting to sign some large contracts over the next year.

The company has 15 employees who are paid salaries through PAYE. The director is looking to acknowledge their contribution as well as retain and motivate them.

Instead of promising bonuses (to be paid through PAYE) based on profits, he is considering an alternative proposal of allotting one share (beyond the 499 he already owns) to an employee-owned NewCo. This will be of a separate class of shares with no rights other than a right to a dividend from Shippy.

Employees would subscribe to shares in NewCo and an agreement drafted to agree a mechanism for payments to be made to NewCo based on Shippy’s performance, distributed as dividends by NewCo to the employees.

The present market value of Shippy is negligible and it is expected that a professional independent valuation of it would not give rise to significant PAYE liabilities on the grant of the shares in NewCo to the employees at market value for no consideration.

I am confident that the aim of the proposal is not to obtain a tax advantage by extracting bonuses as dividends instead of through PAYE – and in response to my concerns that HMRC may seek to tax NewCo’s dividends as subject to PAYE and National Insurance (having regard to examples in HMRC’s Employment Related Securities Manual ERSM90210), my client still wants to proceed.

As an aside, it is accepted that by virtue of its excluded activities the company would not qualify for an enterprise management incentive scheme.

Could readers comment on matters to be wary of in respect of this proposal?

Query 19,633 – Waves.

Conditional sale

Is there a VAT problem with rent discount?

One of my clients rents space in a big department store that sells clothes as a shop-in-shop arrangement. My client’s business is mainly the sale of women’s clothing and she is registered for VAT.

The store owners have decided to rebrand the store to produce a more up-market image, which it feels is necessary following the Covid-19 crisis to set itself apart from the competition. This will also benefit my client by producing more sales.

However, it is going to cost my client £90,000 plus VAT to revamp her own signage and branding in the store, with changes also needed to the way that stock is laid out on shelves.

To help with the costs incurred by my client, the store has agreed to reduce permanently her rent by £10,000 each year. The lease expires in five years’ time, so this is a rent discount of £50,000 for my client.

My question relates to VAT. The store owner does not charge VAT on the rent to my client, ie there is no option to tax election in place. I would have said that there was no VAT problem here but a tax colleague has said that a recent business brief issued by HMRC has clouded the waters.

Can readers help please?

Query 19,634 – InStore.