Business residence

Tax on UK consultancy of a non-resident owner.

A client has been running a computer consultancy business for some time through a company registered in the UK. There are no IR35 implications because he has short-term contracts. He has always been resident in the UK and we have prepared accounts and the CT600 and filed these as appropriate.

Although our client’s contract is with UK companies, we now discover that he went to live in France back in July 2019 but failed to mention this. It seems that his move to France is permanent, although he still retains a property in the UK which has been let out.

Occasionally, he returns to the UK to work and stays with family members when he does so. At those times he carries out some work in his clients’ UK offices. The rest of the time he works remotely in France. Our concern is that his company may be considered to be non-UK resident because the management and control seems to be in France. We understand that the French tax rates are higher than those in the UK.

What do readers think? Would it make any difference if he has contracts with companies based in France?

Query 19,699 – Dualist.

IR35 and corporation tax

Trading losses created by deemed payments under IR35.

Joe is an IT consultant who works through his company Joe Ltd that billed its major client, Lewis Ltd, £160,000.

Let’s say that Lewis Ltd reviews its contract with Joe Ltd and determines that it is within the IR35 off-payroll rules. Lewis Ltd advises Joe that he will be caught. Joe disagrees and appeals under the client-led appeal process. Lewis Ltd then has 45 days to review the position and advise of any amendment.

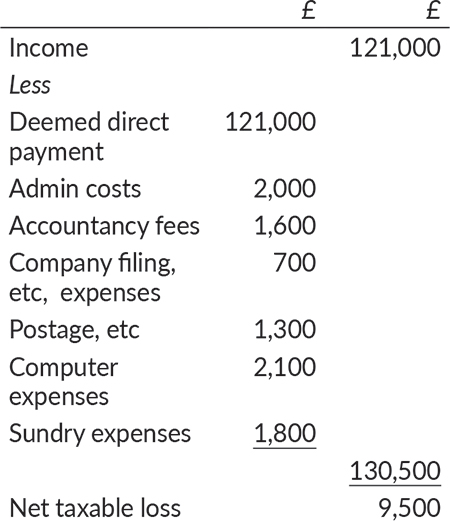

Lewis Ltd completes its review and confirms its view that Joe is caught by the off-payroll rules. From April 2021, Lewis Ltd duly puts Joe Ltd’s fees through its payroll, deducting income tax of £32,000 and National Insurance of £7,000 under PAYE. The net payment of £121,000 is referred to as a deemed direct payment. The turnover figure for the accounts shows the net amount received by the company (£121,000).

The company makes up its accounts for the year ended 31 March 2022, which show a profit of £111,500 (income of £121,000 less expenses of £9,500).

When preparing the corporation tax computation, a deduction will be allowed for the deemed salary payment under CTA 2009, s 139 which states that ‘this section applies for the purpose of calculating the profits of a trade carried on by an intermediary which is treated as making a deemed employment payment in connection with the trade’.

The company’s adjusted corporation tax trading result would be as follows:

Can the trading loss created by deducting the deemed payment be carried forward to be used against future trading profits, investment income and capital gains, should they arise?

Alternatively, would HMRC raise a question as to whether the company is really carrying on a trade ‘on a commercial basis’ if the individual is, in effect, working as an employee?

I am interested in responses from Taxation readers on this grey area.

Query 19,700 – E L Goog.

Industrial buildings allowance

Reliefs and clawback eligibility on property disposal.

Before I started advising them, my clients, who are a married couple, acquired a warehouse unit in 1979 and claimed industrial buildings allowances over the next 25 years. They are now divorced and looking to sell the unit. The unit was not used by them and was just rented out.

My understanding is that there will be no clawback of income tax relief and there are no reliefs on the capital gain, subject to reviewing the 31 March 1982 valuation.

Could Taxation readers confirm whether my understanding is correct?

Query 19,701 – Curious.

Brexit goods challenge

Claiming VAT from German tax authorities post-Brexit?

My business sells mechanical equipment and all the goods we buy are imported from a manufacturer in Germany. Since 1 January 2021 and the end of the EU transitional deal, we have had no problem with the new import rules for getting goods into the UK, electing for postponed VAT accounting and making customs declarations, etc.

However, one of our customers is a business in Sweden, registered for VAT in that country, and goods are shipped directly from Germany to Sweden, rather than coming into and out of the UK. The German manufacturer has never charged us VAT on these goods but an invoice just received has added 19% German VAT. The manufacturer has said that this charge is necessary because the UK is no longer in the EU. Is this correct? If so, can I reclaim this VAT from the German tax authorities – I have read somewhere that a 13th Directive claim is the correct route.

Readers’ help would be appreciated.

Query 19,702 – Stockholm.