Key points

- HMRC’s Raising standards in the tax advice market consultation.

- The deadline for comments has been extended.

- The scope of the term ‘tax adviser’.

- Should more effort be spent on prosecutions?

- The pros and cons of a ‘kitemarking’ scheme.

- HMRC’s role in public education.

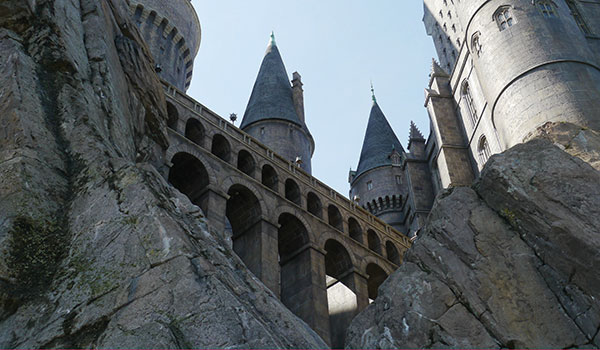

Readers may recognise the title quote above from Harry Potter and the Order of the Phoenix, when the Ministry for Magic places an official at Hogwarts to ‘oversee matters’. With this in mind, we can review HMRC’s consultation, Raising standards in the tax advice market (tinyurl.com/wqhqkar) and consider the impact on the wider tax profession, particularly if HMRC is believed to be overseeing it.

The loan charge review

The outcome of the review of the loan charge was published in December 2019 (tinyurl.com/uj87kl5) and highlighted that ‘scheme usage continues to be extensive in the 2019-20 tax year to date, with over 8,000 individuals having entered into loan schemes between April and October 2019. A key driver of ongoing scheme usage is a limited number of promoters and professional advisers who are selling schemes in spite of knowing that they will not deliver the tax benefits being promised.’

Sir Amyas Morse’s recommendation was: ‘The government must improve the market in tax advice and tackle the people who continue to promote the use of loan schemes, including by clarifying how taxpayers can challenge promoters and advisers that may be mis-selling loan schemes. The government should publish a new strategy within six months, addressing how the government will establish a more effective system of oversight, which may include formal regulation, for tax advisers.’

Accordingly, HMRC issued the ‘raising standards’ consultation to discuss ways of improving the quality of advice provided by those who identify themselves tax advisers. This article discusses some of the suggestions laid out in the consultation and looks at areas of difficulty and contention.

Originally due to close on 28 May, the deadline for comments on the consultation is now 28 August 2020 (11.45pm).

The consultation

The consultation starts by explaining that although ‘the majority of good tax advisers add value, there are a minority of tax advisers who do not’. Unfortunately, this is the case in all professions and we need to ensure that any additional requirements brought in to safeguard the public do not further increase barriers to entry to the tax profession.

The consultation explores the meaning of tax adviser; for example, does it include people who provide tax compliance services – in other words, tax agents – or only those who provide an advisory service. It also discusses the options currently available to HMRC to penalise promoters and notes the promoters of tax avoidance schemes (POTAS) rules and FA 2012, Sch 38 (‘Tax agents: dishonest conduct’) whereby HMRC can penalise those who promote abusive avoidance schemes.

It is also worth noting at this point that some of those who sell schemes may not be regulated by a professional body and are therefore unlikely to be subject to relevant disciplinary procedures.

In Tax Adviser magazine (June 2020) Jim Harra, chief executive of HMRC, said that HMRC ‘recognise that promoters of mass market avoidance schemes are rarely members of a professional body’. The consultation also mentions that ‘the vast majority of major accountancy, legal and banking firms and others who are members of the professional bodies no longer design or sell mass marketed avoidance schemes’.

Further, HMRC’s standard for agents (tinyurl.com/hblvklq) outlines the requisite behaviour from individuals who represent or advise taxpayers on their tax affairs. Those who sell schemes do not always represent taxpayers in front of HMRC, nor do they necessarily advise them in relation to their wider tax affairs (see previous paragraph). They provide an outline and some examples of how a structure may affect one particular area of a person’s affairs, albeit that this is likely to have the biggest impact on the tax liability. As such, those promoters who know of the standard may consider it does not apply to them.

Powers against promoters

Any increase in ‘policing’ the market of tax advisers is likely to be ineffective if the only people who can be further monitored are those who are already regulated. The unregulated advisers (though I use the term loosely), which the consultation appears to wish to monitor, are already the subject of a number of legislative provisions, including the POTAS rules, as well as HMRC’s ability to refuse to deal with the relevant adviser if the department considers their conduct to be substandard. HMRC may also pursue criminal cases or apply civil penalties for such cases.

Thus, there do appear to be enough powers at the department’s disposal to deal with the less scrupulous advisers and those who sell schemes.

A search of ‘tax scheme promoters arrested’ on the internet produces some results, primarily in relation to the loan charge. However, a search of ‘tax scheme promoters convicted’ gives no results relating to the UK. There are however results in relation to Canada, Australia and the US. See Ian Whitehurst’s article on HMRC’s enforcement process (Taxation, 4 June 2020, page 8).

HMRC has been known to take promoters to court to demonstrate that they are in breach of the disclosure of tax avoidance schemes (DOTAS) legislation, one example of which is Hyrax Resourcing Ltd (TC7025) (see tinyurl.com/y8mpq3sg). Once the courts agree, the scheme promoter is required to provide HMRC with details of the scheme users. The department can then pursue the taxpayers for back taxes and penalties and appears to be happy enough with that. It seems to be the case that, by the time HMRC considers prosecution, the scheme providers have liquidated the companies and are unable to be found easily. Thus, prosecution becomes more difficult and promoters remain free to set up a new scheme.

We must be realistic. While there are taxes, there will always be people seeking to exploit loopholes and reduce liabilities. HMRC may wish to consider accepting this and perhaps spend less time debating how to police a regulated profession (where even the regulators are regulated) and more time convicting those who act illegally, even if it costs money to do it. Making examples out of a few scheme promoters would go further to deter others who, currently, may believe that the authorities do not wish to spend time or money on court cases without an immediate financial benefit to the exchequer. Deterring promoters will have a future impact; money has to be spent on these cases first to see a long-term effect.

Further suggestions

There are other suggestions that could be implemented, although it should be noted that those who promote schemes and fraudulent conduct are unlikely to adhere to these rules. Conversely, those who do comply with such rules are likely to be those who are already regulated and are unlikely to commit fraud or sell schemes. Promoters promote schemes not because they necessarily believe the schemes work, but because they earn commissions out of doing so. Nonetheless, such suggestions could include:

- making ‘tax adviser’ and ‘tax agent’ protected words so that only regulated professionals can use them and ensuring that those who do so illegally are stripped of any income they earned during the time of use; and

- requiring every tax professional to include in their engagement letters a paragraph on the suspect nature of tax avoidance schemes and specify whether the person is a regulated tax adviser.

Government kitemarking

The consultation also considers government ‘kitemarking’ as a potential option for advising the public about whether their tax adviser is ‘good’ or ‘bad’. Although I assume the kitemarking will be made independently of HMRC, the risk is clear.

HMRC is a tax collection agency and, particularly in the tax investigations sphere, clients want to know their adviser is on their side. Being kitemarked by HMRC as a good adviser may therefore have a negative impact on turnover – would the public perceive the adviser as being on HMRC’s side rather than having the best interests of the client at heart?

Also, depending on the financial and bureaucratic requirements of being kitemarked, this could affect barriers to entry for small businesses in terms of time as well as the financial impact. We already have anti-money laundering and other start-up costs, the general data protection regulation (GDPR) as well as rent and rates, together with the paperwork that goes with running a business. Adding extra requirements without any real benefits would be unnecessary and again penalise those who consent to being regulated.

Alternatives

We are talking about regulating a minority who are always a step ahead; they cannot be identified until the deed is done. So perhaps the better way would be to further educate taxpayers on what is permitted and what is not. In the same way that the common reporting standard letter was sent by every adviser to every client, a letter can be sent to every person who completes a self-assessment tax return about the dangers of tax avoidance schemes, what to look out for, questions to ask and penalties for making mistakes. The letter should be sent by HMRC; those who are targeted by promoters may not have advisers or may have advisers who do not send letters.

The loan charge review states that promoters sold schemes by:

- misrepresenting the DOTAS system to claim that schemes had been approved by HMRC;

- providing opinions from queen’s counsel (QCs) suggesting that HMRC would not be successful if they tried to claim the tax; and

- minimising the importance of HMRC opening enquiries by suggesting that this was normal.

Publicity campaigns

The document sets out the behaviour of promoters and HMRC can use this information to draft a letter and publicity documents that clearly and unequivocally contradict statements made by promoters.

If in doubt, the taxpayer should be urged to obtain a second opinion from a third party and, potentially, tax advisers should all charge the same fee for a review, which should be paid for by the promoter. If the promoter is convinced their scheme works, they should be happy to foot the bill for a third-party review.

The only way to stop promoters is by forcing them out of business by taking away their clients. The best way to do this is to educate the public so they know what to look for.

Most HMRC publicity campaigns have been easy to miss. To maximise publicity, this needs to be approached in the same way a business would – money needs to be spent creating the right publicity materials and targeting the right people. HMRC can work with contractor websites, placing educational adverts on there; it can take out advertisements on public transport and in free newspapers that most commuters read. It can also put letters into every self-assessment notice sent out. HMRC needs to engage with the public as well as the tax profession. We all know the hallmarks for tax avoidance, the general public do not.

Conclusion

Most people do not mind paying taxes. They resent paying too much and seeing little value in return. There is one other drastic measure – reduce taxes. This is likely to reduce the temptation to enter into aggressive and abusive avoidance schemes. But is the government willing to risk short-term pain for long-term gain? Probably not, particularly in the current environment.

As Professor Umbridge says: ‘Let us move forward, then, into a new era of openness, effectiveness, and accountability, intent on preserving what ought to be preserved, perfecting what needs to be perfected, and pruning wherever we find practices that ought to be prohibited.’

Professional tax advisers should continue to work with HMRC, but the responsibility of bringing promoters to justice and educating the public needs to start at the top.