Issue : Vol 185, Issue 4728

22 Jan 2020Concerns about the loss of privacy

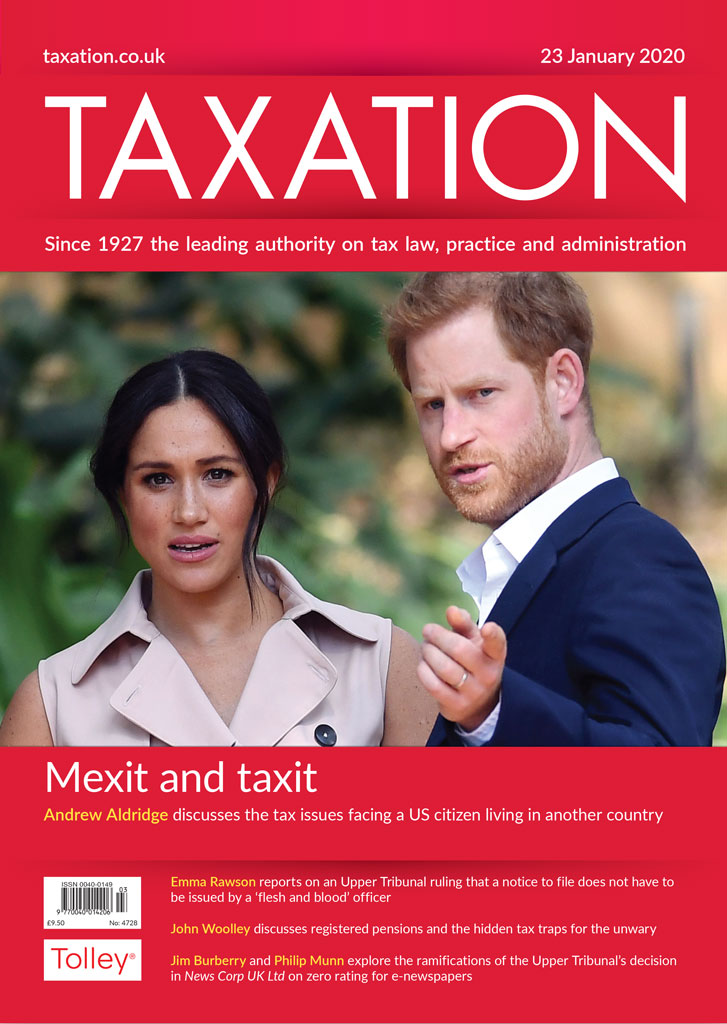

Mexit and taxit

Man versus machine

Pension traps and opportunities

E-publication success

Sale of overseas property by former non-resident.

Foreign pay and investments for returning UK citizen.

Potential sale of employee benefit trust loans.

Sports hire VAT dilemma.

Anomaly?; Returning to UK; An unnecessary complication; Machine leasing

Anomaly?

Annual exemption on non-resident trust gains. I deal with the compliance for a number of non-resident...

HMRC’s calculation of Scottish income tax revenue for 2017-18 as £10,916m was fairly stated, according to the National Audit Office (NAO). However, its report, Administration of Scottish...

The Taxation Disciplinary Board has issued a short consultation document on its sanctions policy. It wishes to ensure it is operating fairly for all parties, bearing in mind in particular the...

The government had laid final versions of two sets of amending regulations in relation to child trust (CTF) accounts. These will start to mature in September 2020 when the first children reach 18. The...

The number of winding up petitions filed by HMRC against businesses has reached a four-year high, according to accountants and business advisers, Moore.The department filed 4,308 winding up petitions...

The legality of the government’s decision to allow failing airline FlyBe to defer a £106m tax bill has been questioned by a tax think tank. The deal is understood to involve the short-term...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES