Issue : Vol 185, Issue 4736

16 Mar 2020

Large business notification

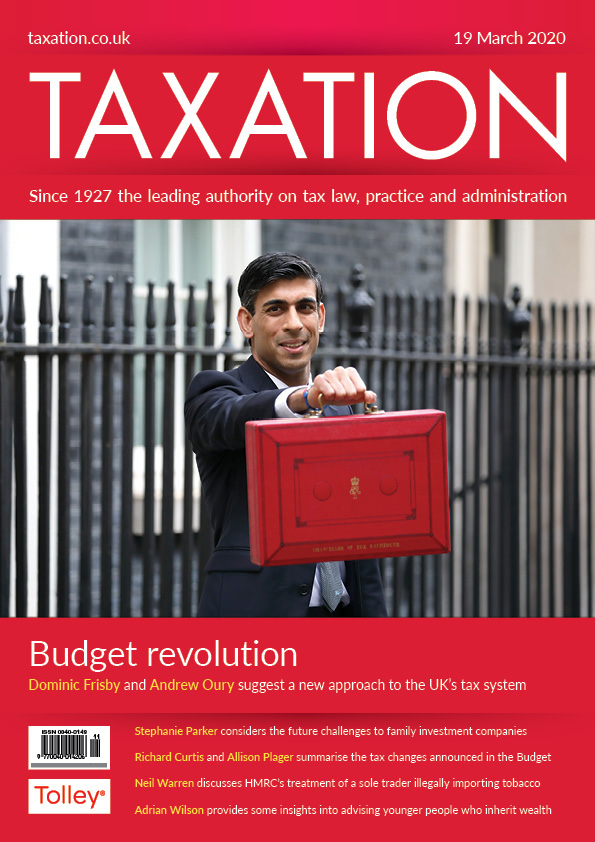

Budget revolution

Family affair

Getting it done

No smoking gun

Young inheritors

Correspondence from readers on topical subjects. Making tax digital continues to divide opinion.

Capital gains tax relief on a property used by a dependent relative.

Entrepreneurs’ relief on a disposal over time.

Offshore land owners; Status decisions; Twist to the tale; IR35 responsibilities

Will a company purchase of own shares recycle funds?

Input tax query on post deregistration expenses

The chancellor has explained, in Employer Bulletin Budget Special, how the government intends to support public services, individuals and businesses that may be affected by COVID-19.For businesses...

The dispensing of drugs prescribed by appropriate practitioners from the European Economic Area (EEA) and Switzerland is to be zero rated. This is as a result of changes introduced in the Human...

The Chartered Institute of Taxation asked members to share their experiences of how HMRC has implemented eight specific post-2012 powers identified for review by HMRC’s powers and customer...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES