Issue : Vol 185, Issue 4737

25 Mar 2020

Extraordinary measures for extraordinary times

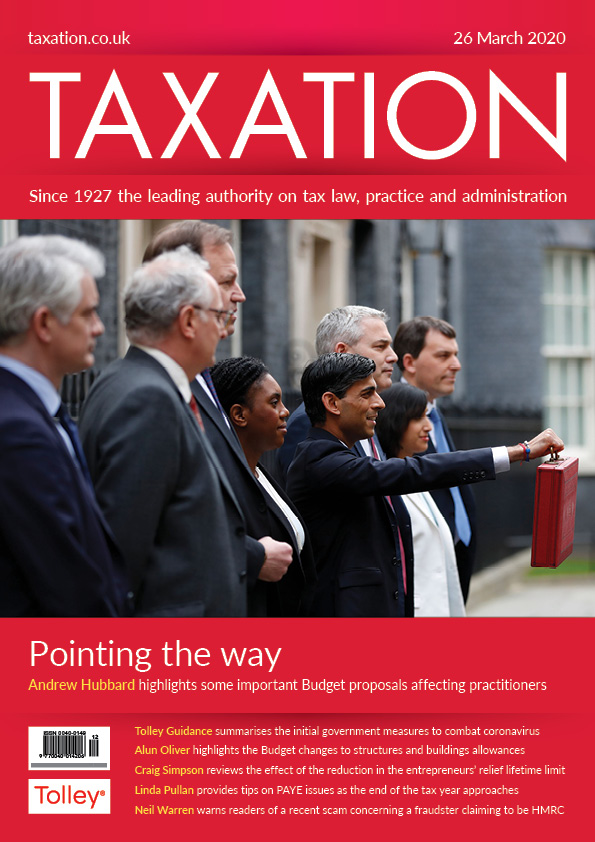

Pointing the way

Coronavirus checklist

Structural inadequacies

End of an ERa – almost

The finishing line

HMRC scam alert

Business property relief on shares in holding company.

VAT incorrectly charged by overseas consultant?

What rate of inheritance tax applies to a ‘free of tax’ legacy?

Application of IR35 to foreign contractors.

New limit In 2011-12, our client incurred a capital loss of £250,000 on the disposal of a quoted shareholding, which was a non-business asset.

In 2015-16, the client had a capital...

Chancellor Rishi Sunak has set out a package of temporary, targeted measures to support public services, people and businesses through this period of disruption caused by Covid-19. The main tax...

The government has published a document asking for suggestions on how to raise and maintain high standards of competence in the tax advice market to protect consumers and improve compliance.HMRC notes...

Judge Richards of the Upper Tribunal has consented to HMRC’s withdrawal of the appeal against the decision of the First-tier Tribunal in the Marina Silver top slicing relief case (TC7103). The...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES