Issue: Vol 175, Issue 4493

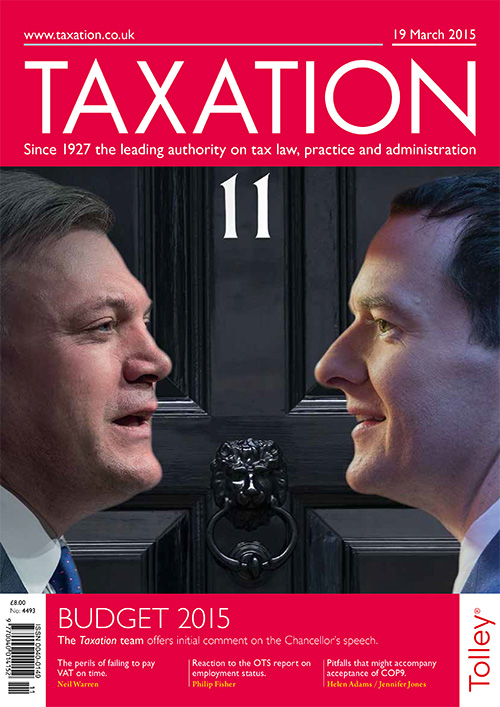

17 Mar 2015First reactions to the chancellor’s pre-election tax announcements

Pitfalls that can arise for clients offered code of practice 9

Why VAT is the most important tax for a company to get right

The OTS’s latest recommendations for employment taxation

Alternative digs; Retirement plan; Diamond VAT; Hotel apartment

Can a new business be subdivided to mitigate the impact of VAT?

Minimising the UK tax liabilities on investments held abroad

Is a trust settlor interested, and how should income be declared and taxed?

What are the potential liabilities on gifts made to an Irish resident?

Revenue Scotland

The Low Incomes Tax Reform Group has welcomed Revenue Scotland’s draft charter of standards and value, which was offered for consultation following extensive informal discussion in...

Tax advisers are being invited to share their views on prototype pages of HMRC’s planned agent online self-serve (AOSS) offering.

The Revenue has published a series of screenshots, which show what...

HMRC recovered £1.1bn tax from transfer pricing enquiries during 2013/14, double the amount collected the previous year, according to official statistics.

Financial secretary to the Treasury David...

Pension holders are being urged to “scam-proof their savings”, as part of a campaign by the Pensions Regulator, ahead of imminent changes to the law.

Under-55s have been the primary target of...

Employment experts have accused HMRC of misleading businesses about the operating cost of IR35.

Statistics released by the department yesterday suggest UK firms spend an annual total of £16m on...

Leekes Ltd (TC4298)

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES