Issue: Vol 169, Issue 4354

18 May 2012

The effect of the settled excluded property provision in this year’s Finance Bill, examined by SIMON McKIE

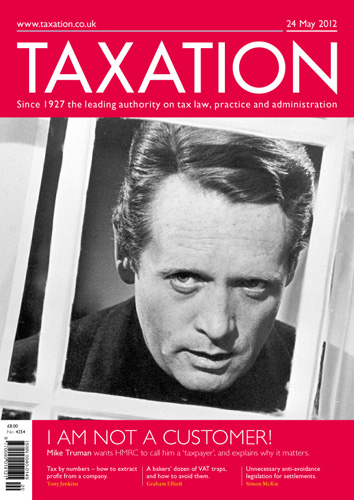

MIKE TRUMAN wants to be a taxpayer again

A batch of avoidable VAT pitfalls is rustled up by GRAHAM ELLIOTT

TONY JENKINS considers the tax-efficient extraction of corporate profits for entrepreneurs

Companies that have cash reserves will be keen to invest these to obtain better returns, but this may prejudice the entrepreneurs’ relief available to shareholders

A business has purchased a motor vehicle on which VAT should be reclaimable. However, because it was bought on hire purchase via a finance company, HMRC are refusing an input tax credit in the absence...

A business has been erratic in making PAYE payments since 2006/07, but the net overall position appears to be that a repayment of tax is due. However, HMRC are requesting month by month...

A couple have divorced and, as part of the settlement, a single premium bond and cash ISAs are to be used to pay for their children’s university education and accommodation costs

Associating spouses; Lettings relief; Salary and scheme; Foreign tax claims

Concern about the issue of HMRC and tax-spend

SSE and capital gains grouping are considerations

Inspector twice arrived much earlier than the appointed time

Mansworth v Jelley; Reconciliations; Gift aid; Stamp duty; Landfill tax

Revenue and Customs Brief 14/12

Registration deadline: 14 June

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES