Issue: Vol 170, Issue 4363

20 Jul 2012

Who is associated with whom, and why? NICHOLA ROSS-MARTIN investigates

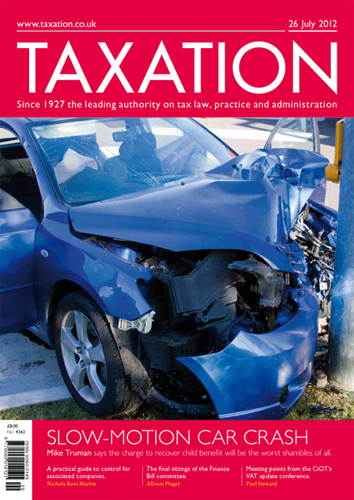

The most shambolic part of the Budget has yet to be seen, says MIKE TRUMAN

The final four sittings of the Public Bill Committee’s debates on the Finance Bill are reviewed by ALLISON PLAGER

PAUL STEWARD provides the highlights of the event in London

A married couple purchased a six-bedroom house and other buildings as well as a nearby three-bed cottage which all together surround a courtyard. The cottage had previously been transferred to the...

Many years ago, a bungalow was bought with the intention it would be a retirement home. It was transferred into the wife’s sole name and was used for holidays and as furnished holiday lettings. It has...

A client signed his self-assessment tax return for the year ended 5 April 2012, returned it to his agent, and then died before the agent was able to submit the form to HMRC. Can it still be submitted?

Two clients, who are brothers, own a portfolio of properties which is held in their joint names. They wish to transfer properties between them so that they are owned outright. Will a capital gains tax...

Journo jousting; Making a sacrifice; Starting over; Carrot and stick

On receipt, Revenue will send assessment for amount

Should it be permitted to use other currencies for computations?

HMRC consulting on likely operation of reduced charge

Update for CAP1 guidance

Students; Royal assent; Tax credits; RTI for expats; CT rates

Proposed changes aimed at saving £3m a year

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES