Key points

- HMRC is continually seeking to reduce the tax gap.

- The department analyses huge volumes of data.

- The Connect software cost £100m but has recovered more than £3bn in tax.

- The software compiles information from a wide range of sources.

- Taxpayers can reduce their risk of an investigation.

The report from HMRC issued on 9 July 2020 on measuring the tax gap makes interesting reading (tinyurl.com/hmrcmtg). The report states that the tax gap in 2018-19 was £31bn or 4.7% of total tax liabilities. Basically, the tax gap is the difference between the tax that, in theory, should be paid to the government and the amount HMRC has actually collected. The amount which should be paid to the government is difficult to measure and is calculated by HMRC using internal and external data and various analytical techniques. The report also indicates that this gap has reduced from 7.5% in 2005-06 to 4.7% now. This percentage gap is perceived by HMRC to be a better measure of compliance over time.

How does the tax gap break down?

According to the report, the biggest gaps by type of tax are income tax, National Insurance contributions and capital gains tax (£12.1bn) and VAT (£10bn). In terms of the type of ‘customer group’, the biggest gap is with small businesses (£13.4bn).

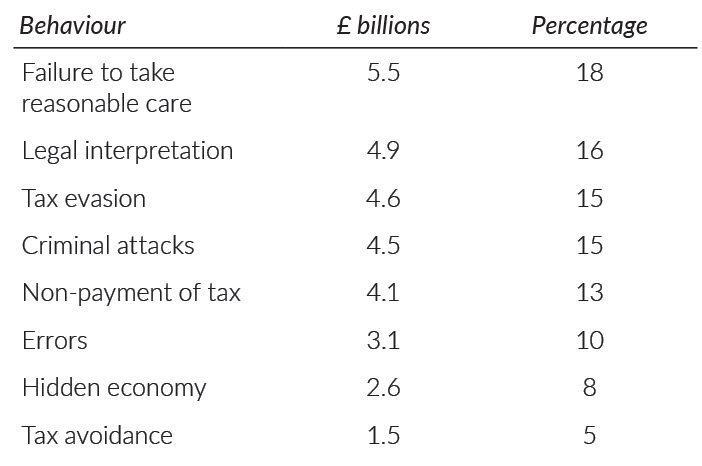

It is interesting to note how the tax gap breaks down between types of behaviour.

Tackling and reducing the tax gap

HMRC has a number of weapons in its armoury to try to reduce the gap and, with a reduction in manpower over the years, computer systems have come increasingly to the fore. HMRC uses a wide-ranging data analytical model which is designed to process and analyse huge volumes of data. The model incorporates a number of analytical tools (Connect and its successor versions), analytical methods (dynamic benchmarking and predictive analytics) and relies on big data (using address matching techniques).

What is Connect?

Connect is sophisticated computer software and is the key data analysing tool used by HMRC. It was introduced in 2010 and was developed with the help of BAE Systems. It is said to have cost £100m, but has recovered more than £3bn in taxes since its launch. HMRC is not keen to talk about it, but makes reference to it in a letter to a House of Commons committee enquiring into reducing the tax gap by using third-party data. In that letter, HMRC states:

‘HMRC’s Connect is a data matching and risking tool that allows HMRC to cross match one billion HMRC and third-party data items. It identifies “hidden” relationships between people, organisations and data that could not previously be identified. Connect has the capacity to highlight patterns in HMRC’s rich reserves of taxpayer and third-party data, allowing HMRC to find anomalies between such things as bank interest, property income and other lifestyle indicators. Once identified, relevant compliance action will be taken. Connect is a very powerful data tool central to HMRC’s work to close the tax gap and tackle evasion which is also being exploited to counter fraud and error in tax credits.’

Connect is split into two distinct parts:

- Analytical compliance environment (ACE) – an analytical environment that allows a small number of specialist analysts to manipulate, analyse and profile data. Tax credit data is placed into the ACE environment to match live claims against HMRC and third-party data, enabling identification of undeclared partners, directors, foster carers, landlords, claimants living abroad and those with private bank accounts, indicating potential undeclared wealth.

- Integrated compliance environment (ICE) – a visualisation tool that presents linked data, shown pictorially on screen, with the results used to enable further targeted risk assessment.

About 3,000 staff across HMRC use ICE and it is a useful tool in supporting the identification of organised attacks.

Connect is run by a team of HMRC specialists in the risk and intelligence service (RIS) and HMRC says that it is using the software to direct resources more effectively, increasing efficiency and improving ‘customer experience’ by improving case selection (for enquiry), quality and strike rate across the compliance spectrum from organised criminal attack to the identification of common errors.

Sources of data used by Connect

There are more than 30 different databases available in Connect for analysis although HMRC does not disclose all its sources of information.

The databases include the following.

- Tax returns (including VAT, PAYE, income tax and corporation tax returns).

- Bank accounts and pensions.

- Credit reference agencies.

- Credit and debit card accounts.

- Online payment providers such as PayPal.

- Foreign tax jurisdictions (including treaties and automatic exchange agreements) and the common reporting standard.

- Government agencies such as Companies House, the Land Registry and the Border Agency.

- Online social networking.

- Property websites such as Zoopla and Rightmove.

- Amazon, eBay, Gumtree and similar sales websites.

- Google Street View.

- Council tax records.

- DVLA records.

- DWP records.

- Electoral roll.

- Insurance companies.

- Charities Commission.

- Flight sales and passenger information.

What leads to an HMRC investigation?

In the past, HMRC enquiries were often triggered by a tip-off to the department by a disgruntled employee or by a former spouse or were random enquiries. Today, enquiries in the majority of cases (over 90%) are triggered by information and analysis generated by Connect.

Cases for enquiry are identified by RIS as being a compliance risk and sent to the appropriate local office for possible enquiry. Selection for investigation is now a multi-tax review covering a number of different taxes which include income tax, capital gains tax, corporation tax as well as indirect taxes such as VAT, stamp duty land tax, PAYE/National Insurance contributions and other areas where HMRC has responsibility such as tax credits, excess pension charges, child benefit claims and the national minimum wage.

Is Connect a reliable source of information?

Due to the wide sources of information used by Connect to piece together a picture of a taxpayer’s affairs, inevitably there will be data which is either invalid or misinterpreted. This will be the case particularly with some of the data picked up from social media. Examples of this include pictures or narrative about luxury cars or expensive holidays.

A person with a grudge may misreport data to HMRC on its tax evasion or fraud hotlines and this can then be incorporated in Connect resulting in an inaccurate assessment of the position with the time, cost and trouble of an unnecessary enquiry by HMRC. As is commonly said about data and computers, the end result is only as good as the information entered into the computer in the first place.

There is a concern that, with such a massive level of data at its fingertips, HMRC may be seen to be misusing the information and some press articles have referred to privacy concerns. Comments have ranged from harm to the UK economy to security concerns surrounding a taxpayer’s personal information. The House of Lords’ Economic Affairs Committee has called for a review of HMRC’s powers to help allay fears that it is becoming too aggressive with open-ended investigations and an uncompromising approach.

HMRC is looking to the future and considering the use of new technology such as artificial intelligence (AI), which will allow Connect to be used to make some of the more sophisticated decisions currently made by HMRC staff.

Reducing the risk

There are several ways taxpayers can help to reduce their risk of a long, drawn-out enquiry with the associated costs involved as well as the stress and time diverted from running their business or their personal and family life. HMRC is tasked with ensuring that taxpayers correctly declare and pay their tax bills. Here are examples of how risks can be reduced.

- Maintain good records of business and personal transactions including invoices and payment records.

- Taxpayers who have failed to correctly declare overseas income and gains should consider making voluntary disclosures using the worldwide disclosure facility which can help minimise penalties. The requirement to correct (RTC), applicable after 30 September 2018, introduced severe penalties

- Use of the ‘white space’ disclosure to provide further information or clarification of transactions on the return will assist in dispelling misinterpretation or misjudgment of information thrown up by Connect.

- If HMRC opens an enquiry, a thorough search of the information available on the internet might indicate something that prompted the enquiry.

- Consider obtaining professional fees insurance to protect against the substantial costs of defending an enquiry by HMRC and possible litigation fees.

In conclusion, Connect is going to be HMRC’s weapon of choice and combining it with AI will give the Revenue an all-powerful weapon to combat wrong-doers. Tax advisers will need to be nimble if they are to protect their clients from unnecessary intrusion into their personal and business lives.

.png)

.png)