Key points

- The government commits to preserving the main residence capital gains tax exemption.

- In general, the linear assessment method of main residence relief is inadequate without the support of ancillary reliefs.

- The planned abolition or curtailment of some reliefs in 2020 will be detrimental.

- An indexed-based assessment would be more equitable, particularly if it was supported by valuation-based appeals.

- A new approach is no more complex to operate and is compatible with abolition of some ancillary reliefs.

- A new approach may increase the overall long-term tax take.

It is a government commitment that the gain on the disposal of a house used as a main residence should be free of capital gains tax. The underlying reason is that the increase in value does not represent a real gain because, usually, the sale proceeds are needed to buy a new home. Sometimes, however, a homeowner will buy a new main residence other than by selling their existing home. For example, they might use their savings or take a new mortgage. In such cases, the tax system should be able to preserve the tax-free increase in the value of the original house at transfer in perpetuity or the state will have crossed a line from taxing gains to taxing savings.

There are many reasons for retaining a former main residence: securing an income, prolonged renovations or construction of the new property, difficulty in selling due to market conditions, legal issues and the like. Whatever the reason, homeowners who do this create a conundrum for HMRC. Although the gain up to transfer should be preserved, capital gains tax should rightly accrue on any subsequent increase in value. But without a transaction at the point of transfer of main residence it is difficult to be certain of this value.

This problem also surfaces in a slightly more complex form if there were periods when the old house, or parts of it, did not have the status of a main residence, such as when it is let or otherwise used as a business, continuously or periodically and in part or in whole. All of these situations are logically, legally (at present) and, in terms of assessing tax, mathematically similar. The central problem is how to meet the government commitment simply, transparently and without expending disproportionate HMRC resources.

The current method and its deficiencies

The assessment of capital gains tax starts with two values known with certainty: the initial purchase price and the final sale price. The current method for valuing a home at any intermediate point in time, and so apportioning gain, is based on an assumption that property values increase linearly. The value at any point between purchase and sale is determined on a pro-rata basis. This prescription, called time- or linear-apportionment, works well if house prices increase everywhere on a straight-line basis, but they do not.

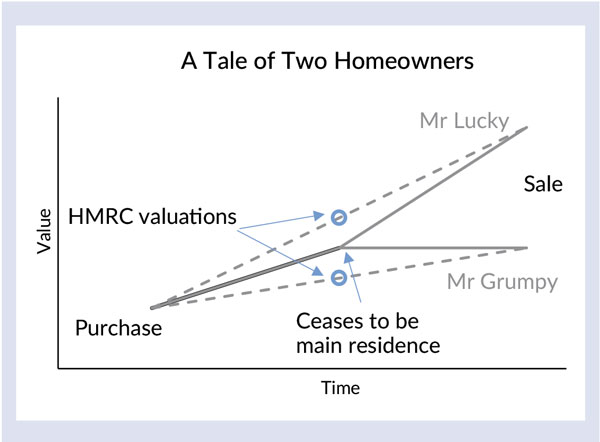

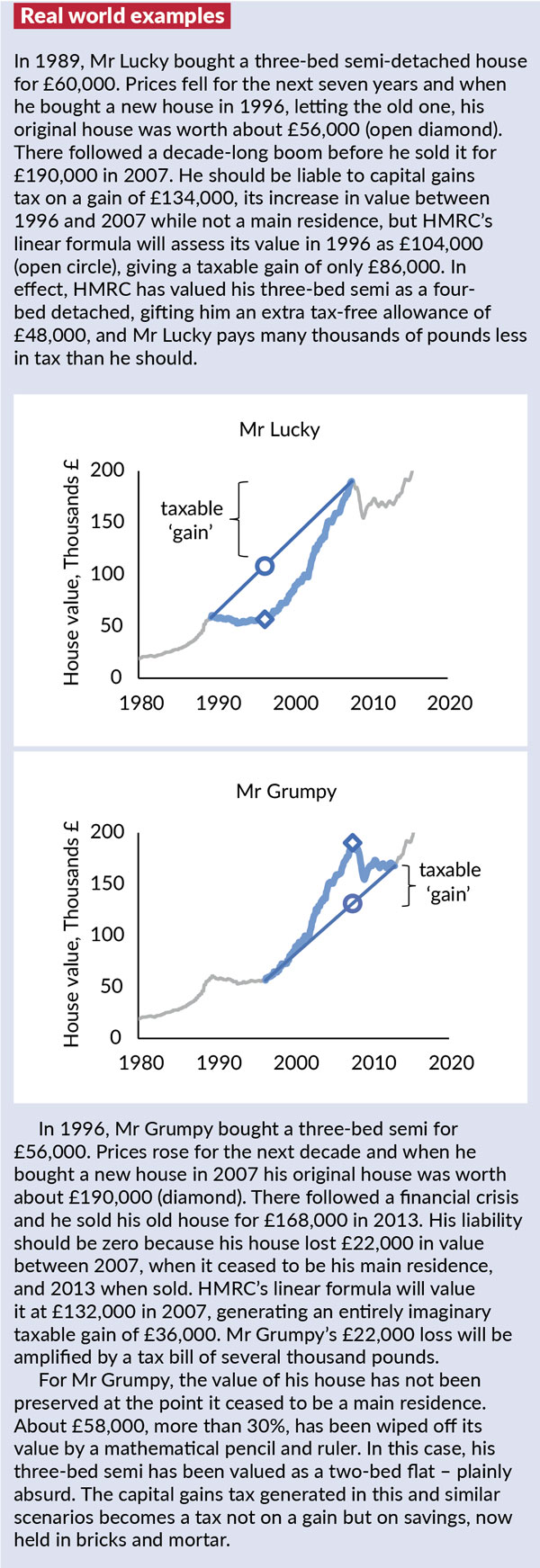

Let’s consider two extreme scenarios in A Tale of Two Homeowners, Mr Lucky and Mr Grumpy, whose house values increase at the same rate while a main residence but differently thereafter. There is a house price boom just after Mr Lucky’s house ceases to be a main residence, so he makes a windfall gain during this period, realised on final sale. He gets a further tax bonus because the linear formula will overvalue the house when it ceased to be a main residence (open circle) and the subsequent capital gain will be underestimated.

Mr Lucky is happy but the Treasury loses out; it should be sharing rather more of his windfall. Conversely, Mr Grumpy suffers house price stagnation after moving out. The linear formula will undervalue his house when it ceased to be a main residence and he will become liable to tax despite making no gain at all during that final period. The longer the stagnation lasts, the lower his house will be valued by linear apportionment and the greater the tax liability will be. Worse, if there is a recession (a fall in house prices) then Mr Grumpy will still be liable despite a steadily increasing capital loss since vacating the property. Virtually the entire gain since first purchase could become liable if the stagnation or recession lasts long enough.

These are not abstract scenarios; they can be illustrated with concrete examples based on average house prices from the Land Registry (see Real world examples). It is the perfect injustice: those who enjoy large gains are rewarded and those less fortunate are further disadvantaged. This is neither equitable nor particularly apparent from the actual assessment procedure, where value is couched in terms of gain and relief.

The only or main residence relief should reflect the true change in value (gain) of the house while a main residence but, except in rare cases, is only allowed by HMRC to be assessed from the overall gain using linear apportionment. The Real world examples do nothing more than present this relief in terms of assessed house value, showing how ineffective it can be in preserving that value.

Mitigating factors

Fortunately, there are mitigations in the form of ancillary reliefs. First, there is the final period exemption. When Mr Lucky and Mr Grumpy (Real world examples) sold their properties, three tax-free years were allowed to sell an ex-main residence, equivalent to subtracting three years’ worth of gain from the liability. Further, for those who make their house available to tenants, there is lettings relief. When introduced in 1980, this allowed up to £10,000 of tax free capital gain during a letting, increased to £40,000 in 1992. As shown later, if Mr Grumpy had let his devaluing house these reliefs would have reduced his tax bill in 2013 to the correct value: zero. He would have lost money in the house price slump after the 2008 financial crisis, but at least he would have been spared tax on the loss. The government’s commitment to preserving the value of a private residence was largely redeemed by these reliefs in this situation.

These mitigations are to be severely curtailed. In April 2020, the exemption for the final period of ownership will be reduced to nine months (having been reduced to 18 months in 2014) and lettings relief will be abolished unless the owner lives in the property. The latter constitutes a radical policy change since its introduction in FA 1980, which recognised all entities that had once been, in part or in whole, a main residence.

Thus, all of those who move during a period of stagnation or recession but have not, for whatever reason, sold their house within nine months will, potentially, face a gradually increasing fictitious gain in the eyes of HMRC, whether or not they rent the unsold house. Tax will eat into their bricks and mortar savings rendering hollow the government’s commitment to protect them.

Clearly, there is a question of natural justice here: the tax system should not reinforce fortune and exacerbate misfortune. It should present a level playing field and fulfil its purpose of preserving from capital gains tax the value of a house at the point it ceased to be a main residence, ensuring that everyone pays the correct tax, irrespective of the evolution of property prices.

Fixing it

Although perfection is hard to achieve, it is easy to do much better using a combination of valuations and indexed assessments. The gold standard would be individual valuations.

If, say, on the purchase of a new main residence, the homeowner obtains a valuation on the existing one then HMRC will have a fixed and firm basis to calculate tax at any future date in the same way as a buy-to-let landlord or any other purchaser. However, this would be resource intensive for HMRC and the homeowner. A more pragmatic method would be indexed assessments.

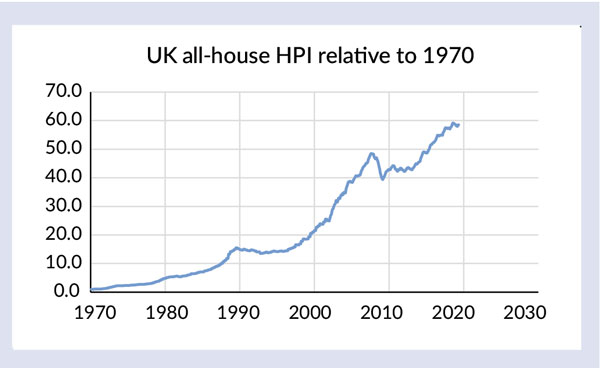

A simple form of house price index (HPI) could offer a viable modern alternative to the present straight-line method. Some examples demonstrate its practicality. The house price index used in these examples is the all-house UK-wide one available from the Land Registry and normalised to unity in 1970 and as shown (UK all-house HPI relative to 1970), but any baseline date could be used as long as it is consistent throughout the calculation. The examples are given in terms of the HMRC system of reliefs.

For clarity, the essentials are restated here. The starting point is the gain on a residence, being the sale price less the purchase price. The chargeable gain is the gain less reliefs, the main ones being only or main residence relief, the final period exemption and lettings relief. There are others – such as when seconded to work away from home – but similar principles apply.

Calculating the relief

A useful approach is to construct a complete history of ownership of a home. Ownership is divided into periods of different main residence fractions, starting with the date of purchase and ending with the date of sale. If the dwelling is 100% used as a main residence the fraction is unity; if it is a second home or 100% used for business the fraction is zero. If several rooms are rented, or an office is dedicated to trading activities, it will be between zero and one.

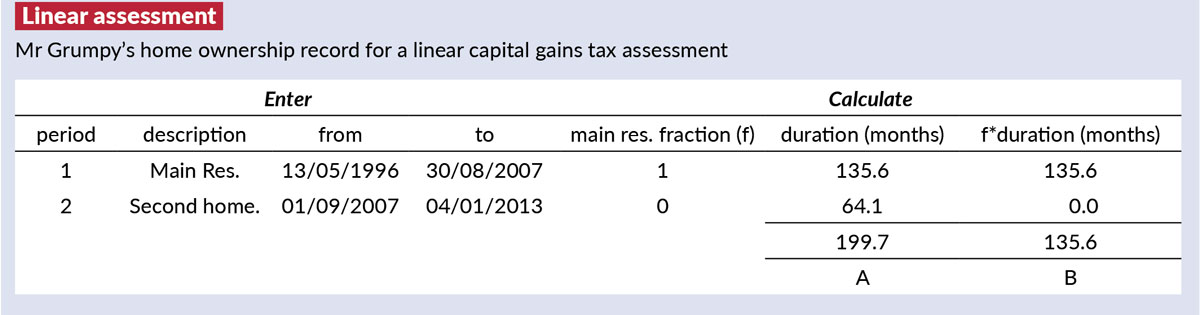

A particularly simple Linear assessment table for Mr Grumpy is shown below.

Time is measured in months but any units will do. A and B are the sums of the last two columns. Main residence relief is calculated from the gain multiplied by B/A. His gain was £112,000 so the relief is £76,000 (£112,000 x 135.6/199.7), giving a taxable gain of £36,000 (£112,000 – £76,000).

The calculation neglects ancillary reliefs. Had Mr Grumpy let his old house until sale he would have benefited from 64.1 months of letting relief which would have reduced his gain to zero and, even if had not so acted, 36 months of final period exemption would have significantly reduced his apparent gain achieving a more just result.

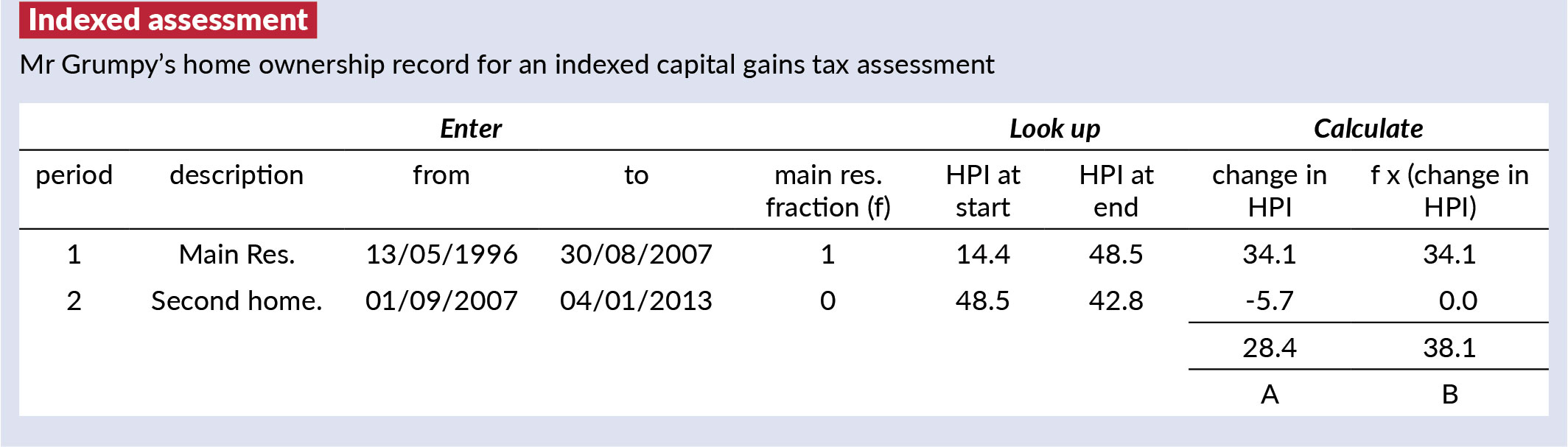

An Indexed assessment looks very similar. The only difference is that instead of calculating the change in time, or duration, of each period, we calculate the change in HPI. Here, Mr Grumpy’s only or main residence relief is £134,500 (£112,000 x 38.1/28.4), giving a loss of £22,500 (£112,000 – £134,500). This correctly indicates that Mr Grumpy made a loss since his house ceased to be a main residence.

Unless the sale price is less than the purchase price, the linear formula is incapable of generating periods of loss, and this feature of the indexed assessment has two corollaries:

- Mr Grumpy will pay no tax, which is the correct outcome; and

- the loss can be offset against other gains.

Further, Mr Grumpy has no need of final period exemption or lettings relief to achieve an equitable result. Using the indexed model means that the final period exemption could be abolished without financial detriment given an appropriate definition of the timing of a sale.

Likewise, lettings relief could be abolished putting landlords and non-letting owners of second homes on the same basis. Alternatively, if its aim is to encourage the letting of empty rooms or properties, it could be retained and incorporated in the indexed assessment in several ways. Shorn of its mitigating role this relief becomes a straight inducement to owners of previous main residences or existing ones that are large enough to have rooms to let.

Practical issues

The foregoing demonstrates that an indexed assessment looks little different from using linear time to apportion gains. There is one additional step, looking up HPI, which takes minutes to complete.

Hand calculations of tax liability remain feasible, and even the lookup step could be automated in a simple app or spreadsheet such that the input required from the user would be exactly the same as the linear assessment. An indexed-based assessment will probably not, in the long term, reduce the income to the exchequer; this income will be higher if house prices consistently outstrip a linear growth.

An indexed assessment has the following advantages.

- It is fairer to everyone. In both booms and busts tax bills will more closely approximate true liabilities. Bonuses for landlord windfalls and scope for surreptitious pilfering of savings by government would be much reduced, or at least balanced across the taxpayer base.

- It is simpler in some respects, in that several reliefs can be discontinued.

- It alleviates concerns about future property prices and government policy on capital gains tax allowances, rates and reliefs when managing the ultimate disposal of a former home.

Admittedly, there are some issues to address.

- There are many house price indices, for different areas, property types and buyer profiles, for example. However, the problem of statistical variations would probably dictate a national or large regional level of indexation.

- No house price exactly follows any HPI. There may be significant local or individual variations. For example, extensive new building in an area may bias house prices upwards making a locality seem to be undergoing a boom when legacy owners are experiencing relative stagnation.

However, the aim of the indexed method is not to achieve perfection, but to arrive at a routine tax assessment that is sufficiently accurate to minimise discontent and reduce the desirability of individual valuations.

Conclusions

On the one hand the government commits to protecting the value of a main residence from capital gains tax but, on the other, presides over an assessment method with the potential to wipe many tens thousands of pounds off that value, resulting in large taxes on small gains or even on losses. Mitigation of this anomaly depends on ancillary reliefs, but important ones are to be abolished or curtailed in 2020. A new methodology is urgently required to maintain equitability.

Valuation-based appeals would cover exceptional cases, enabling full justice to be delivered for all: homeowners, HMRC and the general taxpayer. The method might simplify the tax system by dispensing with some extraneous reliefs. Finally, the proposal

should not reduce the overall tax take over the long term and may increase it.