Issue: Vol 168, Issue 4322

15 Sep 2011

VAL HENNELLY explains HMRC's approach to various aspects of the new disguised remuneration rules

BRIAN REDFORD looks at how the Revenue is supporting small and medium-sized enterprises

The aim is to get the right tax at the right time. DAVID GAUKE explains how this will be achieved

JOHN MOORE, MARTIN ROBERTS, BARBARA SKORUPSKA, TONY SADLER and JEREMY TYLER provide clarification and advice on statutory and non-statutory clearances as they are applied to company reconstructions

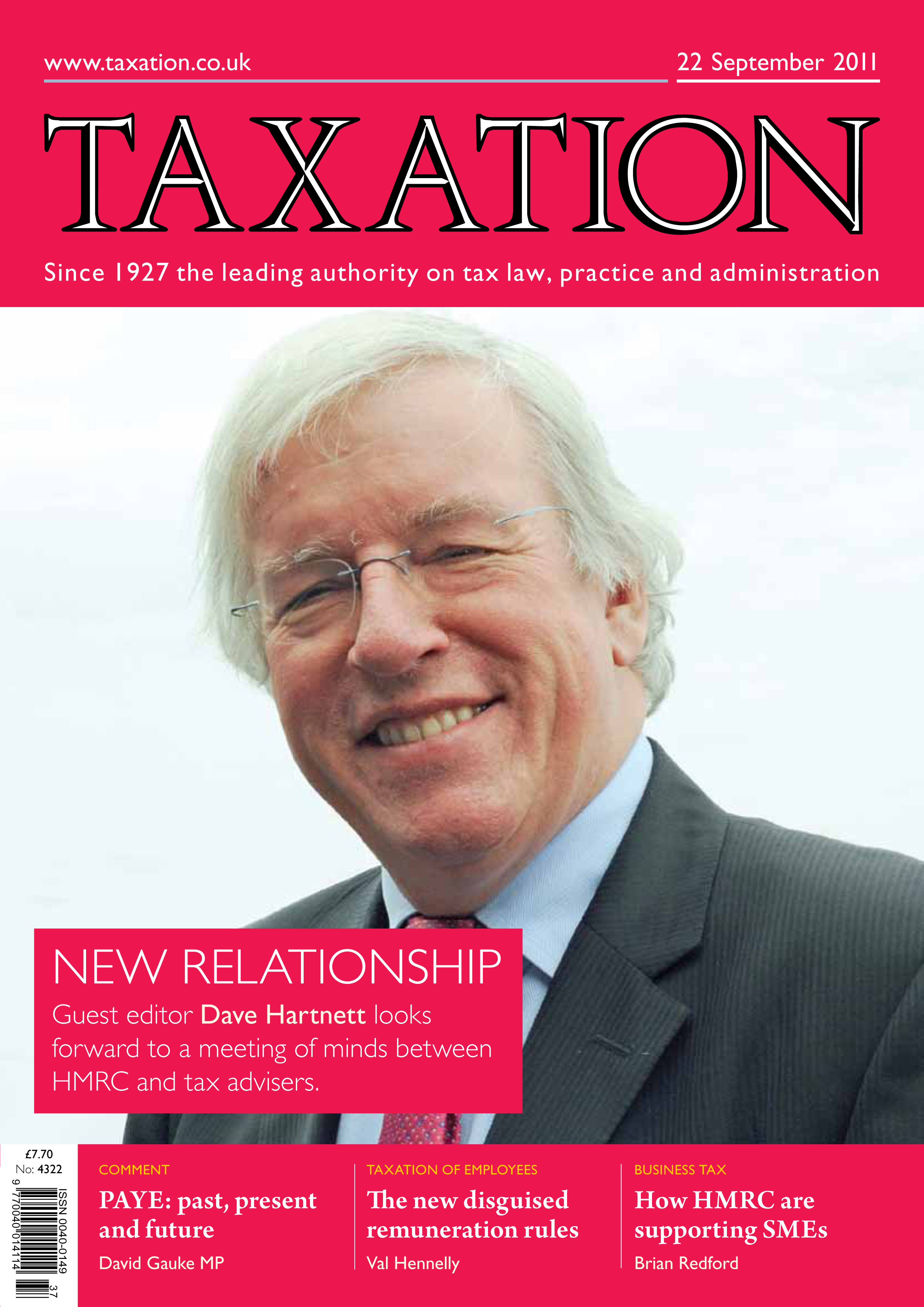

Guest editor DAVE HARTNETT welcomes readers to an issue in which HMRC set out their views on topical subjects

A firm pays expenses to its employees to reimburse them for expenditure incurred in the course of their employment

A UK-resident higher rate taxpayer became a director of a company in the Republic of Ireland. Double taxation relief was claimed on the UK self assessment tax return for tax paid in Ireland, but...

The purchaser of a florist’s business also wishes to buy the firm's premises (which are subject to an option to tax) from the landlord

A convenience store was badly damaged in recent riots and insurance proceeds may not cover the full costs of repairs. The customers have collected a substantial sum for the business owner

Tax at one o’clock; Corporate partners; The wrong code; Trust tangle

Association of Disabled Professionals helps clarify point

'Legislation reflects removal of requirement for company to claim for small profits rate'

'I am completely against the imposition of any obligation to register'

'A largely unpublicised scandal'

HMRC not be appealing against the Michael Golding decision

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES