Issue: Vol 171, Issue 4402

14 May 2013A claim for input tax can still be made by a business in the absence of a tax invoice

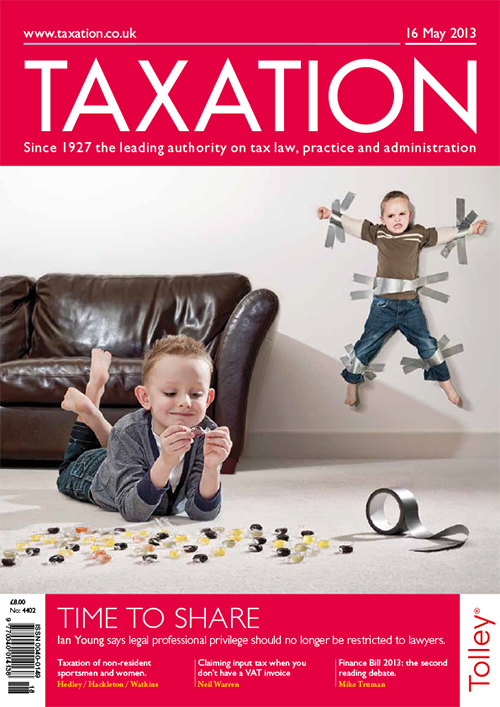

Taxpayers should be entitled to the best possible advice from the professional most qualified to give it

An athletic look at the taxation of non-resident sportspeople’s endorsement income

MPs ought to actually look at the provisions of the Finance Bill rather than just use them to score political points

MPs ought to actually look at the provisions of the Finance Bill rather than just use them to score political points

Employees are allowed to claim an authorised mileage rate for business journeys and a higher rate is paid for the first 10,000 miles a year

A VAT-registered taxpayer realises the flat rate scheme would have been beneficial and wants to register on a retrospective basis

Confusion as to the capital gains tax reliefs available often arises when a taxpayer has two residences

...Trust transfer plan; Italian imports

...charities online; offshore funds; PAYE notification

New online tool should be approached with caution, says tax barrister

Mistakes discovered in nominations

Download the exclusive Xero

free report here.