Issue: Vol 171, Issue 4404

30 May 2013There are dangers in ITEPA 2003, s 222 if the strict time limit is ignored

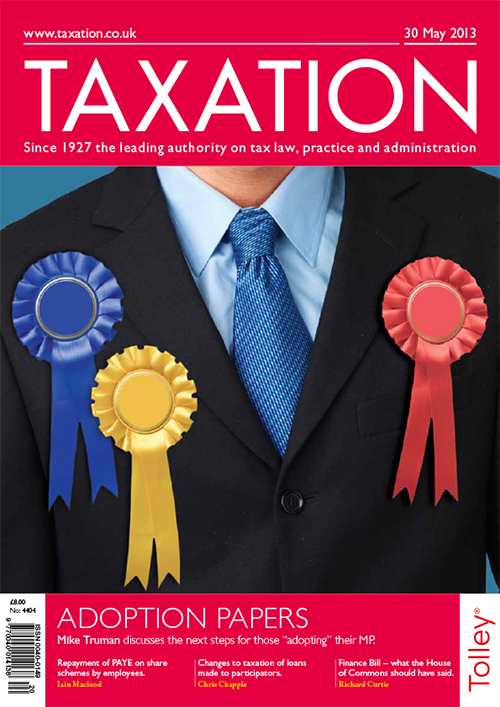

The latest developments in our campaign to create better tax knowledge among MPs

A careful look at the changes to the taxation of loans to participators and other extractions of value from close companies

Structured, considered and informed, or political one-upmanship? The continuing debate over Finance Bill 2013

A non-UK domiciled but resident client has used the remittance basis since 2008/09 and made an election under TCGA 1992, s 16ZA. Remittances have been made to the UK from a mixed offshore fund

A father’s will left three quarter shares of his estate into trust for his three children for life and then to the children of one of them. The income requirements of each of the life tenants have...

A local water authority owns land that adjoins a farm. The authority wishes to carry out work to its property, which will require access to the farmland. Compensation has been agreed but will this be...

An entrepreneurial client has built up an unquoted company. He now owns 100% of the share capital, having acquired other holdings from elderly relatives. Those transfers were subject to holdover...

...Pension for pension; Underwriting loan

The Treasury is consulting on how to provide additional funding through the tax system to support digital media production in the UK, including the visual effects sector. The government is keen to...

...PAYE; VAT notes; Negligible values

Limited tax relief will be available from June for workers whose employer pays or reimburses the charge for subscribing to the Disclosure and Barring Service (DBS) update service, and for criminal...

HMRC have issued a consultation on two aspects of partnership rules, with the intention of removing the presumption of self-employment for some limited liability partnership members to tackle the...

Incorrect real-time information tax codes are being issued for businesses that have submitted employer alignment submissions (EAS) or full payment submissions (FPS) that are incomplete or...

Public Accounts Committee confirms findings of audit office

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES