Issue: Vol 173, Issue 4451

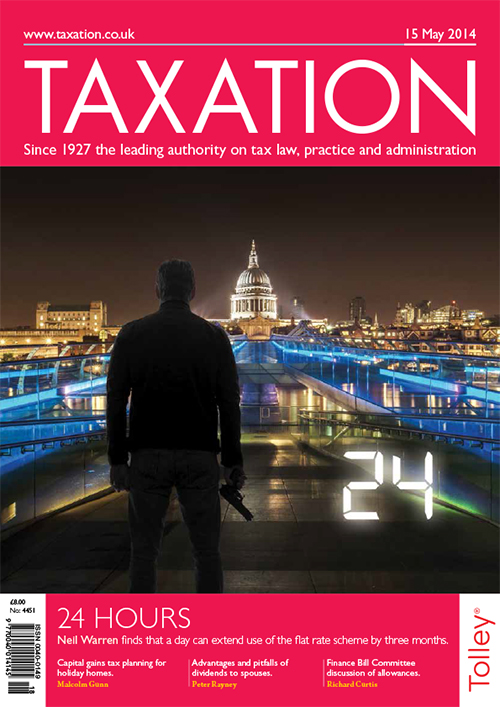

13 May 2014A legislative oddity extends the VAT flat rate scheme membership by three months

Quirks of capital gains tax on holiday homes

Advantages and pitfalls of dividends paid to spouses and civil partners

The first Finance (No. 2) Bill 2014 committee meetings maintained the usual low standard

Exemption entitlement; Loss of goodwill; Import VAT recovery; Going clubbing

Advice is required on how ITTOIA 2005, s 629 taxes the trust income on the settlor of a parental discretionary trust and how payments to the children are matched against the “available trust income”

...

The majority shareholder of a trading company sold his shares for cash, shares and qualifying corporate bonds in a new holding company

A limited liability partnership (LLP) consists of the taxpayer and a limited company. The company has taken the largest profit share but this is undrawn, while the taxpayer has an overdrawn account

...

A UK resident, but non-UK domiciled, taxpayer has used the remittance basis since 2008/09. On reflection, it appears the arising basis would have been more beneficial

Professional fees

The Income Tax (Professional Fees) Order SI 2014/859 amends ITEPA 2003, s 342 and adds a further two categories of professional fees to those allowable. First, a trainee...

HMRC have published further guidance on eligibility for the employment allowance.

It includes clarification of “functions either wholly or mainly of a public nature”. Where more than 50% of the work...

The first complete tax year under real-time information (RTI) for the majority of employers worked well, with only one major problem, according to the taxman.

HMRC have been conducting weekly...

The annual allowance for retirement savings has fallen to £40,000 from £50,000.

The change – with effect from 6 April 2014 – means pensions contributions in excess of the cap during a tax year may be...

HMRC now calculate tax credits awards through the real-time information (RTI) system.

The new set-up – effective from 6 April 2014 – means renewals notices will show the total gross pay for the year,...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES