Issue: Vol 174, Issue 4462

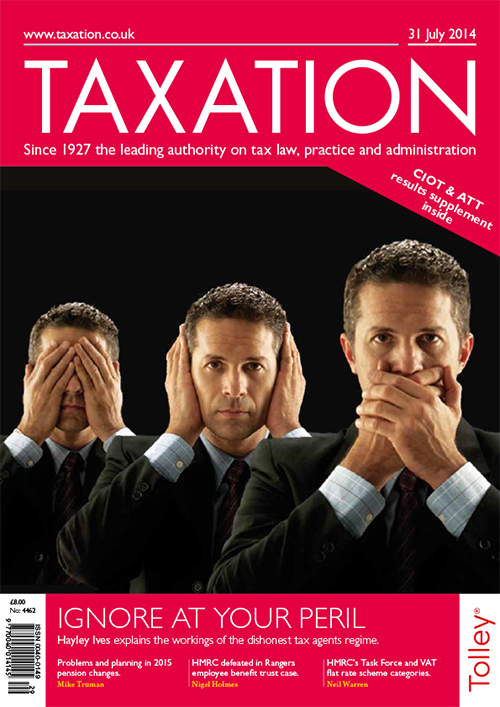

29 Jul 2014Advisers need to be familiar with the dishonest tax agents regime

Bad news in the government’s response to its consultation on liberalising pensions

What next for HMRC following their loss in the Glasgow Rangers case?

Warning: chosen VAT flat rate categories are in danger of attack

Could partnerships could be members of VAT groups?

Tricky trust; Card confusion; Suggestion scheme; PT and VAT

Is a fraudulent sale of assets, later reinstated, a capital gains tax disposal?

Can the transfer of a going concern rules apply if connected parties are involved?

Complying with real time information when monthly pay receipts are uncertain

Tax relief on costs incurred on a property purchase that does not proceed

Emergency services

HM Treasury has published a consultation document on extending to all members of the emergency services the inheritance tax exemption for armed forces personnel who die on active...

Victims of missold interest rate hedging products (IRHPs) must declare compensation payments, HMRC have stressed.

Some taxpayers became entitled to redress payments following a review in light of...

HMRC are offering users of contractor loan schemes the chance to avoid litigation over their tax affairs.

The schemes are complex arrangements by which individuals sign an agreement of employment with...

HMRC have launched plans to reduce the administrative burden for businesses subject to the annual tax on enveloped dwellings (ATED).

A new consultation document by the department comes in light of the...

Employee share option schemes look set to become simpler for companies to handle, as the government considers implementing a recommendation from the Office of Tax Simplification (OTS).

A consultation...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES