Key points

- Disability magnifies the problem of having to deal with a complex tax return.

- More people are seeking help from the tax charities.

- TaxAid and Tax Help for Older people provide help to people who are vulnerable because of poverty or a range of other conditions.

- Donations are always needed – www.bridge-the-gap.org.uk.

It was Emma’s sister who called our helpline. Emma’s tax problems had mounted because of her disability – dyslexia and computer illiteracy – and when, finally, she could no longer cope on her own, she turned to her sister. She, in turn, contacted TaxAid.

We learned that Emma had been a single mother since the death of her son’s father in 2013. This loss resulted in the family home being sold and Emma and her son moving into a one-bedroom flat. Emma became self-employed in 2015 and because she suffered from dyslexia and computer illiteracy, she found employment by carrying out work such as gardening, cleaning and childcare.

Although she did register with HMRC as she was supposed to, when the letters arrived telling her she needed to complete a tax return she did not understand what they meant. When she contacted HMRC for help she was pointed towards online resources. However, because of her dyslexia and computer illiteracy, this did not help.

At this point she really needed someone to help her understand what was needed, and then to help her complete the forms. Instead, she was left feeling more confused and worried.

Letters continued to arrive from HMRC, with penalties for not submitting the returns. Emma paid the penalties as they came through, hoping this would help, but the letters and the penalties did not stop coming.

Over a prolonged period of time, Emma ended up paying more than £4,700 in penalties to HMRC when her annual income was only approximately £6,000.

Emma finally turned to her sister for help after being unable to claim benefits – because her tax records were not up to date. When Emma’s sister contacted TaxAid on her behalf, Emma had been scraping by on the bare minimum as her work had dried up as a result of the coronavirus pandemic.

At TaxAid, we were able to complete her tax returns and successfully appeal against the late filing penalties. This meant that Emma received a refund of £4,711.17 from HMRC, representing the penalties she had paid. Emma told us this had lifted an enormous weight off her shoulders. She was finally free of the fear and stress she had endured and worried about for so long.

Learning disability and tax

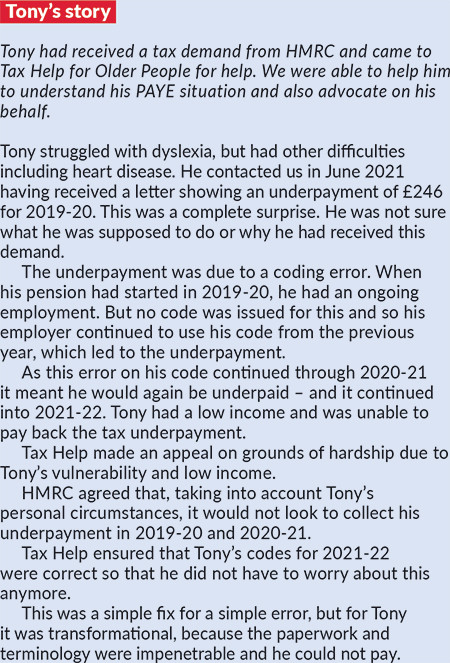

Emma is one of many people who have a learning disability who come to our helplines. Another example, Tony, is described in the box opposite.

There are some 1.5 million people in the UK with a learning disability. Very few of them – about one in 20 – are in paid employment yet the numbers who come to us are relatively high. Learning difficulties include dyslexia, dyspraxia, ADHD (attention deficit hyperactivity disorder) and several other conditions. They can lead to problems with maths, impaired reading, memory difficulties, poor organisational skills or difficulty following instructions.

We know how our family members and friends can struggle with tax so it is not difficult to envisage why people with learning difficulties can also have problems with their tax. For them it is many times worse – their disability magnifies the problem of being faced with a complex form like a tax return. And if they live in poverty, as many of them do, they can have nowhere to turn for help.

Learning disabilities are one of many disabilities and factors that contribute to poverty. Nearly half of all people in poverty in the UK either live with a disabled person or are disabled themselves.

How the tax charities can help

TaxAid and Tax Help for Older people provide help to people who are vulnerable because of poverty or a range of other conditions. For a high proportion of all of the people we see, while tax is the immediate issue to be resolved, the root cause lies in their vulnerability.

Our staff are skilled at working with clients like Emma, finding out what the problem is and taking steps to get things straightened out.

As a result, we can resolve a problem that may have been troubling them for a long time. And this in turn transforms their health and their outlook going forward. For people with learning difficulties, as with many of our clients, our advice really does change lives.

Will you help us help Emma this Christmas?

People in the tax profession understand the need for the tax charities and there is a lot of good will towards our work. But goodwill alone does not pay the bills. We rely on people’s generosity in giving support.

Our Bridge the Gap campaign raises donations from people in the profession for TaxAid and Tax Help for Older People. Will you help people like Emma this Christmas?