Issue: Vol 172, Issue 4426

31 Oct 2013Article 17 of the OECD convention model discriminates against touring artists and sportspeople, claims the European musicians’ network FEVIS

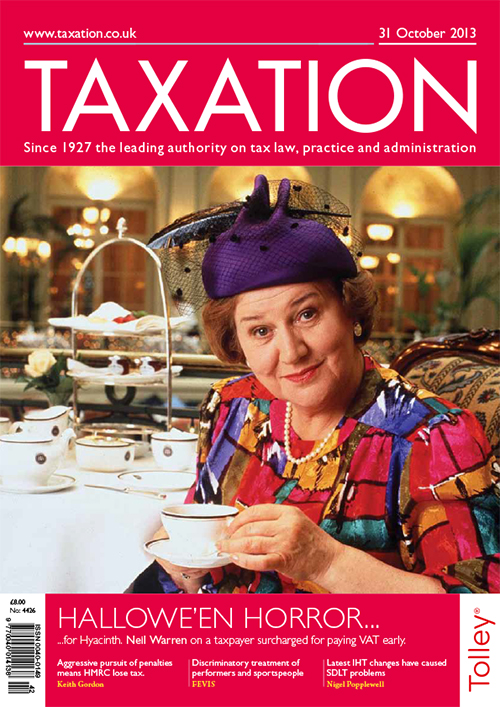

...for Hyacinth. The scary situation in which a business makes an early VAT payment to HMRC but suffers a default surcharge

Revenue Watch: the department needs to rethink its attitude to fining compliant taxpayers

FA 2013 changes to solve inheritance tax problems can cause unexpected stamp duty liabilities

How should the works created by an artist be valued in the accounts that are prepared up to the date of his death?

A house was inherited and sold a few months later at a substantial gain. Capital gains tax will be payable, but what acquisition value should be used?

...To opt or not; Loans to participators

HMRC are to once again revamp their business records check (BRC) programme, putting greater emphasis on educating taxpayers.

Download the exclusive Xero

free report here.