Issue: Vol 173, Issue 4442

6 Mar 2014Claiming a construction industry scheme refund can be an overlong process

Pitfalls to avoid when claiming agricultural property relief

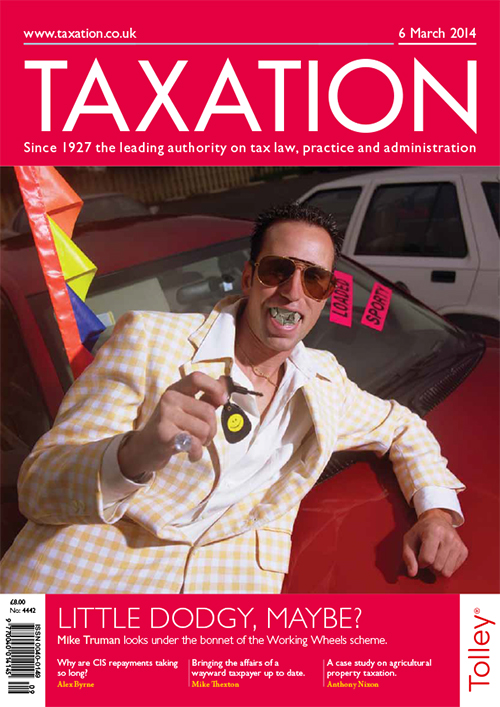

How could anyone have believed Working Wheels was legitimate?

One adviser’s tale of helping a wayward driving instructor with outstanding liabilities

Three-way split; Sibling transaction; Place in the sun; Residential conversion

A client is proposing to transfer a large residential property to his son. The client will continue to live at the property and pay a rent. This should avoid an inheritance tax charge

A pottery collector is expanding and improving his collection. Because of the limited space available, unwanted or inferior examples are sold to make room for more recent acquisitions

ICAEW “right behind” quality standard that experts call “ill-conceived”

Forde and McHugh Ltd v CRC, Supreme Court

Marks and Spencer v CRC, Supreme Court

Download the exclusive Xero

free report here.