Issue : Vol 178, Issue 4557

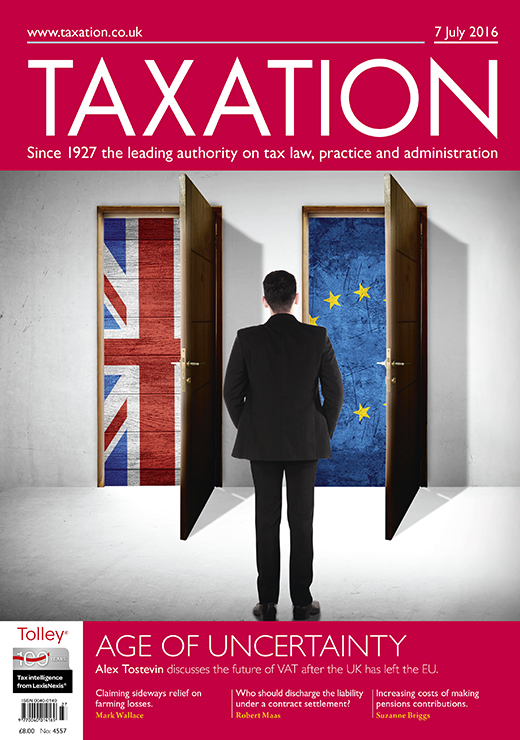

5 Jul 2016What VAT might look like after Brexit.

The higher tax cost of making pension contributions into a smaller pot.

Farming losses and sideways relief.

In praise of the First-tier Tribunal.

The Women in Tax group and its plans to encourage career progression.

The Chancery Division’s unexpected decision in Shah v Insafe International Ltd.

National Insurance; Property division; Dividend dated; Flat rate changes.

The VAT exemption for fundraising events and ‘not for profit’ bodies.

Can a non-EU national claim the ‘EU defence’ on Dutch income?

The tax implications of garden sale and building development.

Advice required on the tax treatment of income from paying guests.

Lack of a formal advance clearance procedure in the TAAR was adding to the uncertainty, said the CIOT

Class 2 National Insurance; basic PAYE tools; talking points.

The open letter has been signed by the chairs of parliamentary finance committees.

Chancellor suggests a further cut could help investment in the UK after the EU referendum result.

Download the exclusive Xero

free report here.